With President Trump moving to drastically reshape U.S. trade policy, it bears remembering that while trade is a hot-button national issue it is also an intensely local one, underpinned by local firms, local workers, and local industry clusters. That’s why we recently mapped data from the Brookings Institution’s Export Monitor to depict the vivid local geography of exporting among U.S. metro areas.

And yet, trade is not just a local matter. It is also a huge priority for manufacturers. Manufacturing today comprises about 57% of U.S. exporting, and as we have written, that production is also a local affair, determined heavily by local competencies, local engineering capacity, and local supply chains. This means that changes in federal trade policy can have large implications for individual manufacturing communities, whether through changes in the terms of trade, or through disruptions or improvements of trade relationships.

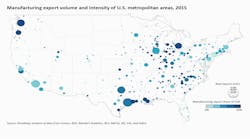

Given this, it is worth exploring the geography of U.S. manufacturing export activities by breaking information on manufacturing sales volume and specialization out of the broader Brookings data.

What does a map of these data show, then? In terms of their overall export volume, the nation’s big, famous manufacturing hubs anchor the U.S. export machine, as we showed in the earlier post. New York, Los Angeles, Houston, Chicago, and Dallas each exported $60 billion or more in manufactured goods in 2015, and as such accounted for nearly one-quarter of the nation’s manufacturing exports and more than 12% of all of the nation’s exports, including high-value services. These figures underscore the huge importance of the nation’s big-city production hubs.

And yet, the big metropolises, while hugely important to the nation’s trade and commerce, represent just part of the picture. In fact, the largest manufacturing hubs are not the ones most proportionally involved in export-oriented manufacturing. Instead, manufacturing orientation—measured as the manufacturing exports share of local GDP—reaches its highest levels in a group of smaller Midwestern and energy-belt localities engaged in exporting machines and vehicles and, in some case, petroleum-derived chemicals.

At the high end, nearly half of the economy in Columbus, Ind., derives from exports, largely emanating from its dense machinery manufacturing cluster. Other places where manufacturing exports account for the largest shares of local economic output are smaller producer communities in Indiana, Wisconsin, and the Gulf states—Louisiana and Texas. Manufacturing exports encompass fully 38% of the economy in Beaumont-Port Arthur, Texas. They account for 30% or more in Elkhart, Ind., Kokomo, Ind., and Lake Charles, La. Racine and Sheboygan, Wisc.,, also derive large shares of their economy from manufacturing exports.

Looking at larger communities, the most manufacturing-oriented metropolitan areas tend to be major centers of advanced industries, reflecting U.S. advantages in aerospace (Wichita and Seattle); automotive (Detroit and Youngstown); electronics (Portland, Ore., and Ogden, Utah), and energy production and down-stream products (Baton Rouge, N.O., and Houston). In all of these economies, denoted by dark dots, manufacturing exports account for at least 10% of GDP and tens of thousands of jobs. By contrast, smaller, lighter-colored dots marking even large metropolises like Miami, Phoenix, and Las Vegas mark the other end of the spectrum: metros with relatively less manufacturing intensity across the Florida and Western Sun Belt.

In sum, while changes in trade policy appear certain to generate heated national and international debate, those changes’ most tangible ramifications will be practical and local. Most notably, those changes will hit home especially in the exactly 100 large and small metros (out of 382) that depend on manufacturing for fully 10% or more of their local economy. In those heartland and coastal manufacturing places, trade is much more than an remote diplomatic affair.

Thanks to Sifan Liu for research assistance and mapping.