"3-D printing has the potential to revolutionize the way we make almost everything."

With that line in his 2013 State of the Union Address, President Obama helped elevate additive manufacturing into the forefront of industrial concern. Not that it wasn't already on its way.

According to the most recent Wohlers report on additive manufacturing, the 3-D printing industry increased 28.6% in 2012, expanding into a thriving $2.204 billion market. In 2013, fueled by support by the President, organizations like the National Additive Manufacturing Innovation Initiative (NAMII) and an unprecedented buy-in from industrial companies throughout the sector, that market has continued to expand at an accelerated pace, well on its way to meeting Wohlers' target estimate of $5.2 billion by 2020.

This is not an overnight success, however.

Additive manufacturing has been changing the way we make things for nearly 30 years, ever since 3D Systems invented laser sintering in 1986. Since then, the industry has worked through a slow evolution, diversifying into a wide, rich range of materials, processes and applications.

Additive manufacturing today can be used for printing anything from plastic trinkets on $500 machines to finished titanium component parts on systems that sell for over $1 million.

GE Aviation, for example, recently announced that in less than two years it will begin 3-D printing fuel nozzles to be used in its jet engines. Along with that, the machines and tools assembling that engine could include as many as 200 jigs and fixtures that are themselves products of 3-D printing.

See Also: Global Supply Chain Logistics Management

So additive manufacturing is certainly changing the way we make things. But the real transformative power of the technology and its potential to, as President Obama said, change almost everything, is beyond simply the mechanics of the technology.

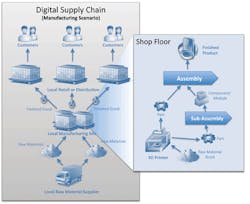

No, the real potential is to transform the way we go about manufacturing—disrupting the age-old supply chain and replacing it with something entirely new: a globally connected, local supply chain.

Razing the System

The promise of a 3-D printing-based supply chain is simple: "Additive manufacturing will democratize the manufacturing process." So says Ed Morris, director of NAMII, the federally-funded initiative set to define and promote the future of the industry.

"In terms of impact on inventory and logistics," he says, "you can print on demand. Meaning you don't have to have the finished product stacked on shelves or stacked in warehouses anymore."

Whenever you need a product, he explains, "you just make it. And that collapses the supply chain down to its simplest parts, adding new efficiencies to the system."

Those efficiencies run the gamut of the supply chain, from the cost of distribution to assembly and carry, all the way to the component itself, all the while reducing scrap, maximizing customization and improving assembly cycle times.

Basically, Morris says, it tears the global supply chain apart and re-assembles it as a new, local system.

The traditional supply chain model is, of course, founded on traditional constraints of the industry—the efficiencies of mass production, the need for low-cost, high-volume assembly workers, real estate to house each stage of the process and so on.

But additive manufacturing bypasses those constraints.

3-D printing finds its value in the printing of low volume, customer-specific items—items that are capable of much greater complexity than is possible through traditional means. This includes hollow structures like GE's fuel nozzles that would normally be manufactured in pieces for later assembly.

This at once eliminates the need for both high volume production facilities and low level assembly workers, thereby cutting out at least half of the supply chain in a single blow.

From there, the efficiencies of that traditional model stop making sense—it is no longer financially efficient to send products zipping across the globe to get to the customer when manufacturing can take place almost anywhere at the same cost.

The raw materials today are digital files and the machines that make them are wired and connected, faster and more efficient than ever. And that demands a new model—a need to go local, globally.

Rise of the Printing Bureau

Central to this system are companies like RedEye—the print-on-demand service division of additive manufacturing giant, Stratasys—a localized network of printers distributed globally to produce parts regionally.

"With the old system, you had designers here designing widgets and then getting a supplier in China to produce it just to send it back and go into inventory," explains Jeff Hanson, business development manager at RedEye. "But what this technology allows us to do is 3-D fax the digital file to any facility closest to the point of origin."

Essentially, he says, engineers from RedEye's Minneapolis home base can "drag and drop" the CAD files for a part directly onto a machine local to the customer, printing in Shanghai what is ordered in Shanghai, printing in Kansas what is ordered in Kansas. Customers can even upload their own designs online for production, bypassing another step in the process.

"This system is green; it saves time and money," Hanson says. "You're not having a UPS truck pick up your parts; it's not going on a FedEx plane. It's not getting picked up; it's not going into inventory; it's not getting handled. It's going right to the digital factory closest to the location without airfare or any of those other costs involved in moving parts globally."

RedEye has six facilities open for regional printing across an area stretching from California to Australia, with two more going up in China and Brazil.

"We're expanding into facilities globally to help enable localized production in each of the different regions of the world" Hanson explains. And he's not alone.

Service bureaus like RedEye are popping up all across the world, positioning themselves to deliver plastic and metal parts, prototypes or models, in the burgeoning market—in what all of them hope to be the future of the supply chain.

And the question on the top of their minds is, "When will it happen?"

That is a very good question.

The Software-Enabled Supply Chain

"Everyone is always talking about technologies that will change the world," says Paul Brody, global industry leader for IBM Electronics. "But if you're a business and you're trying to plan an investment, the question really is, ‘When does this become relevant?'"

To answer that question, Brody's team set out to test the viability of a true supply chain disruption via 3-D printing and related technologies and to put together a timeline for payoff.

"Starting right now for smaller items and within five years for larger ones, we expect that 3-D printing will be the single largest driver of supply chain transformation," he says.

Furthermore, he adds, "Within 10 years, it will be somewhat or substantially cheaper to make large and small products locally in a digital supply chain."

This is not the usual hyperbolic wish-think that proponents of the industry tend to dish; it's the result of an intensive research project at IBM that tested the market impact for three transformative technologies: 3-D printing, intelligent robotics and open source electronics.

The project began by first tearing apart a mix of technologies—a washing machine, a large industrial display, a cellphone and a hearing aid—and reimaging their manufacturing, assembly and delivery process piece by piece.

Employing a complex simulation model, Brody's team rebuilt the supply chain from scratch, leading with 3-D printing.

"We built an integrated supply chain model of these global supply chains and reconstructed it to find the optimal supply chain for each product based on rough approximation of demand using these technologies," he explains.

What he found was a startling validation to the hyperbole.

According to the official results—published in the report, "The New Software-Enabled Supply Chain"—within the next decade, these technologies can produce an average 23% unit cost benefit and reduce the level of required economic scale by a whopping 90%.

"Now," cautions Brody, "of course 23% isn't exactly a revolution. I would expect traditional manufacturing to improve its own productivity that much during that time period."

But that 90% reduction in economic scale, he says, is "earth shattering."

"It means that, today, if you have a factory that you need to run a million units to remain profitable, in the future, you will need less than 100,000," he explains. "That is huge."

This, he says, provides a real financial incentive to begin shifting the supply chain away from the large enterprises of the complex global supply chain and into the smaller, simpler and local systems the technology allows.

The best evidence of this, he notes, was with the smallest of Brody's test products: the hearing aid.

With the hearing aid today, he explains, what you have is a product that is designed in the U.S. or Europe, the critical components are manufactured in emerging markets and then assembled in China. Once completed, the final product is shipped to the U.S. for customization and delivery to the customer.

"When we ran the supply chain optimization algorithm through the new technologies," Brody notes, "what it said is, it is economically efficient to basically design and manufacture and sell locally-made hearing aids in every major city."

And that's big indeed.

In the end, a single line from the IBM report captures the potential disruptions offered by 3-D printing and the hopes of every new market on the cusp of the boom: "By changing requirements for scale, location and volume, the software-defined supply chain won't just change costs or manufacturing processes—it will effectively upend the industry structure as we know it."

Travis Hessman is associate editor of Material Handling & Logistics' sister publication, IndustryWeek.