Returnable containers are valuable assets. Unfortunately, they're not top of mind among many supply chain workers. Some see very little value in them and equate them with any other transport packaging commodity. Others recognize not only their value as containers but also the value of their base materials on the open market—and therefore may be tempted to find ways to extract that value through illegal means.

See Also: Global Supply Chain Logistics Management

What's needed in any supply chain flowing with returnables is accountability at every level in the organizations throughout that chain, whether at the supplier, a distribution center, a carrier, a transportation provider, a logistics service provider or anyone at the final destination. It's everyone's responsibility.

Tracking: An Automotive Priority

Players in the automotive industry learned the importance of shared responsibility long ago, thanks to organizations dedicated to helping it improve its supply chain productivity and security. The Automotive Industry Action Group (AIAG) is one of those organizations, and it has a position on its staff dedicated to "supply chain program development" to support those causes. As AIAG's manager of supply chain program development, Jim Zamjahn follows trends in the use of assets like returnable containers. Once in a while he'll be surprised by what he learns in his research.

"There's always been theft of returnables, but what has surprised me is the rise in reporting of those thefts," he says. "In some cases it's organized. Organized theft rings profit from trafficking in these containers. Crooks will take advantage of situations where there is vulnerability, whether it be at a DC or carrier yard. If there's no tracking program associated with them they become fungible assets."

Thanks to the Sarbanes Oxley Act, more companies are paying attention to the value of all their assets. Where returnable containers were once the tip of the iceberg, they're quickly becoming the whole iceberg for many shippers.

Avoiding Expendables

More shippers are recognizing the other values associated with returnable containers, as well. Many made the move to returnables from expendables some time ago. A large percentage did so to avoid sending trash to their local landfills. Others did so for financial considerations as well as to keep their plants and warehouses clean. Having corrugated in a plant can create handling and dust issues, which are especially problematic in production environments. And in the case of wood pallets and containers, unless they come from known and reputable sources, there's a risk of introducing invasive species into your environment.

OEMs, suppliers and service providers in all supply chains are collaborating through their trade associations and industry groups to deal with such issues. In the case of automotive, the AIAG has three working groups dedicated to returnable containers alone: standardization, visibility and tracking. AIAG is also following what industries around the world are doing to better manage their supply chain assets. Pooling programs offer a good example.

Pooling has been a longstanding business practice in Europe, but has not been widely adopted in the U.S. where containers are concerned. It's seen as a longer term option here. However advances in technology and pooling management programs may lead more industries like automotive to adopt pooling solutions where plastic containers are concerned. That may give manufacturers better utilization of all of their supply chain assets as well.

"The introduction of returnables coincides pretty neatly with the introduction of JIT practices and lean production principals," Zamjahn says. "The automotive industry has wrung a lot of cost out of its supply chain already, but better management of a returnable container program could represent an opportunity to save even more."

Through its working groups, the AIAG is dealing with requirements calculation—getting the number of containers to fill a need right in the first place. With a closed loop system this is pretty straightforward, but there are many other things that must be considered, i.e., managing "milk runs," including work-in-process and different setup times for different types of parts. AIAG plans to develop a best practice where this is concerned.

"The automotive industry's supply chain for inbound material is as sophisticated as any in the world, but returnable containers are still considered the ugly stepchild," Zamjahn continues. "Once the parts are delivered to a line the container tends to lose its visibility. That makes tracking and accountability key."

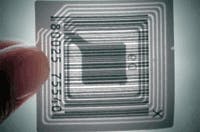

What about RFID?

"Radio frequency identification (RFID) tags have limited use right now," Zamjahn believes. "Some companies are exploring the RFID option, and we could see increased use of RFID in the future. However the problem for now is reading the RFID tags in this kind of environment, not their cost."

If you have a closed loop system you're generally OK, he adds, but even then there can be shrinkage or leakage.

"I suspect if you go to any assembly or supplier plant in the country, along their back fence you'll see hundreds or thousands of orphan containers that don't belong to them," he continues. "The complexity of identifying ownership and the cost of returning in small quantities makes it next to impossible."

Theft of containers is a multi-million-dollar proposition, owing to the scrap value of resins and metals. One automotive OEM recently lost over $700,000 worth of a container type they had to replace.

Industry Collaboration

Standardization is one possible answer. In Europe, VDA, the German Association of the Automotive Industry, has seven standard containers. It is expected that at some point all American industries will follow suit and standardize their returnable containers to deal not only with theft, but with their carbon footprint. Until then, just putting your name on your containers may not be enough. Bar coding is another answer, but that still requires the discipline to develop an accounting process to track them through various distribution points. That includes at the assembly plant where they're used, consumed and back out the door to the supplier where they belong.

All companies in all industries, at every level in their supply chains, would do well to appreciate the value of returnable container management. In automotive the AIAG is engaging 3PLs as well as the OEMs and suppliers in its membership. Zamjahn believes that until every authority in the supply chain treats containers as they do parts, disappearances will continue to be a problem.

"Together we can help industry identify what works and what doesn't," he says.