The State of US Logistics 2024: Shippers Learn Logistics Is No Silver Bullet

“I don’t know what’s normal anymore,” admitted Ron Marotta, vice president of Yusen Logistics International Division, and a member of the panel of industry experts who helped launch the 35th annual State of Logistics (SOL) report at the National Press Club in Washington, DC, this June.

His remark pretty much sums up how logistics professionals regard the current situation, which seems ready at any time to plunge in one direction or the opposite. “Waiting for the Tide to Turn” is the title of this year’s Council of Supply Chain Management Professionals (CSCMP) report, researched and authored by the Kearney global management consulting company and sponsored and presented by Penske Logistics.

“The period covered by this year’s report—the calendar year of 2023 and the opening months of 2024—has only confirmed that admonition about the certainty of uncertainty as shippers and carriers wait for the tide to turn in a period where no tide table seems reliable,” the researchers point out.

This year’s report highlights some of the trends in logistics observed over the period covered, building on the observations made about macroeconomic, logistics and transportation trends in last year’s report and other recent reports. New this time is the more prominent explorations about the various strategies the Kearney researchers recommend for logisticians and modal managers to deploy to deal with the constant twists and turns they will face on the uncharted paths opening up under their feet.

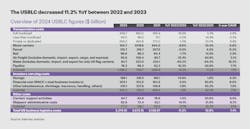

In 2023, US business logistics costs (USBLC) decreased 11.2% from the previous year, dropping from $2.672 trillion to $2.374 trillion (see Figure 1). All told, USBLC in 2023 represents 8.7% of the total US GDP, down somewhat from the 10.5% figure in 2022 but still the third-highest percentage of US GDP over the past decade.

While all kinds of pressures impinge on the supply chain from every direction, shippers are attempting to address them by taking a more holistic approach to meeting their logistics needs, and in the process are breaking down traditional barriers that divide them from third-party logistics providers (3PLs) and asset-based carriers. It seems that in this new age of perplexity, abandoning the old categories appears to be a promising approach, according to the report’s authors.

It is in this regard that the newest SOL will prove to be an invaluable resource for professional logisticians, giving them vitally needed tools and strategies to cope successfully with the infinite number of possibilities the future holds.

Among the most unpredictable guideposts are the macroeconomic developments and other exterior forces that shape the world in which everyone must operate. Just a few examples are our toilsome national election season this year; threats of widening wars in the Middle East, Ukraine and China; and potential domestic economic shocks like the threat of a longshoremen’s strike shutting down U.S. East Coast ports later this year.

According to the SOL report researchers, we can expect to see just 2.5% in worldwide economic growth over the course of 2024, down from the 2.7% registered last year. If this prediction proves true, they believe this year could mark the close of the slowest half-decade of output growth in 30 years. Economic growth in the U.S. also has slowed and that growth has been and will continue to be uneven, the panelists at the SOL press conference agreed. For example, construction in some industry segments has been robust, while in others it’s been weak.

Managing the Freight Challenge

Retail sales, which are responsible for 70% of the nation’s GDP, remain relatively flat although e-commerce sales have continued to grow steadily since they exploded during the COVID shutdowns. This trend also has helped fuel continuing growth in the freight transportation and logistics services sectors, although it is not proceeding at as furious a pace as it did during the pandemic.

The impact on transportation and other service providers has been uneven, with some able to profit in the new environment while others have failed. Ocean carriers have enjoyed strong profits even while U.S. companies who have been their customers have embraced a move towards nearshoring some of their manufacturing operations. Most of the trucking sector, however, saw a precipitous drop in rates which have not fully recovered—again with a notable exception: some parcel carriers who are heavily involved in e-commerce.

Trucking companies suffered such a persistent downward swing in rates that some of them closed or declared bankruptcy—but fewer than would have been expected under the circumstances, according to the researchers, who believe many carriers are still surviving on the fat profits they accumulated during the pandemic, when their services were in the most demand.

The cyclical nature of the over-the-road freight market will continue to fuel a challenging rate environment for carriers, they say, but it is due for an inevitable rebound. Shippers are urged to remain aware of how crucial it still is to build strong logistics management teams to bolster an organization’s ability to continuously evaluate its transportation mix using analytics that will allow them to make strategic pivots in carrier relationships.

This includes drawing upon a new generation of increasingly sophisticated technological tools available for monitoring and managing their trucked shipments. Among these are new digital freight-matching tools that allow captive fleet operators to supplement their own volume with that of third-party shippers, enabling higher levels of utilization and filling of deadhead miles—key to controlling trucking costs.

The researchers also see promise in the rapidly advancing field of artificial intelligence (AI). “Although the timeline for a full AI revolution is uncertain, shippers must stay vigilant, as the impact will no doubt be significant,” the researchers stress. “AI [will] enable a dynamic, automated approach to asset allocation which allows shippers to continuously align their asset mix to market conditions.”

For example, machine learning models are predicted to strengthen shippers’ ability to make confident, risk-averse decisions while minimizing capital expenditure. “Over the coming years, AI will surely also integrate itself into loading planning operations targeting reduced dwell times as a means to boost productivity.”

Managing in an Uncertain World

Similar advice is offered to those who must grapple with the fast-changing challenges that have surfaced in regard to managing ocean and rail transportation and warehouse services., including labor challenges and rate inflation which already have battered the supply chain and threaten to persist into the near future.

For those who are dependent on these services, the researchers offer much the same advice as they do in regard to managing trucking services: Get smarter and get the right technological solutions. “It is imperative for carriers and shippers to upskill, collaborate and take advantage of industry capability advancements to improve capacity, utilization and manage costs,” they assert.

The ocean shipping environment is experiencing downward pressure on rates due to slackening in demand and ocean carrier overcapacity—they simply built too many ships. Customers can take advantage of that to prepare for an uncertain future in which shipping faces growing threats from ocean pirates in the Red Sea and other seas adjacent to armed conflict, a worsening Chinese economy, and the continuing threat of labor turmoil at U.S. ports.

“Shippers should engage more frequently with carriers to ensure competitive terms and conditions, and to further diversify their transit modes and routes,” the researchers advise. “This should include a greater openness to short-term deals and spot market arrangements when feasible, taking advantage of carriers’ margin pressures amid continued stagnant demand.”

The warehousing boom has cooled as shippers look more at finding ways to avoid soaring inventory carrying costs. The just-in-case model that was adopted during the COVID pandemic has slowly but perceptibly started shifting back to more of an emphasis on a just-in-time (JIT) delivery model for some shippers.

During the second quarter of 2023, big-box retailers Walmart, Target, Lowe’s and Home Depot combined brought down inventory levels by 4%, the largest quarterly inventory drawdown for these retailers collectively since 2015, the researchers point out. In the meantime, construction of new industrial warehouse space has continued at a healthy pace and rents have remained high.

“As businesses attempt to ease inventory pressures, they have adopted various strategies to deal with excess and obsolete inventory, including discounting products through sales, shipping product to other regions, or purchasing space solely for storage,” the report states.

The researchers say companies are seeking to define “a refined inventory strategy, including the establishment of guardrails regarding stock levels and days of available supply. Retailers in particular will need to balance between the sometimes competing values of reducing excess inventory, maintaining resilience, and having capacity for agility in the future.”

The trend towards JIT means that manufacturers will need to make some adaptations in order to foster flexibility in managing supply disruptions. The researchers say that companies should remain cognizant of potential shifts in consumer demand and continue to drive toward the economic equilibrium of running lean and having contingencies in place to adjust inventory levels when the situation calls for it.

All of this blends together to put additional pressure on logistics managers by increasing critical scrutiny of the promises made over the years by the advocates of 3PL services—including some of the 3PLs themselves.

In response to decreasing inventory levels and pressure to reduce costs, the researchers say that companies are choosing to reduce their warehouse footprints after years of rapid expansion. Adding to this is the consolidation trend happening across the specialty storage spectrum, such as refrigerated facilities, which has picked up.

Is 4PL Around the Corner?

Most commercial warehouse operations offer a menu of 3PL services, and both asset-based and non-asset-based logistics providers were in a great position during the pandemic and immediate post-pandemic economic period. However, past promises have not lived up to customers’ expectations completely in the post-COVID environment, and both 3PL customers and their providers realize that changes will be needed to successfully grapple with these new challenges.

One upshot is that some large shippers are increasingly looking to market their internal asset base and logistics capabilities to external clients, transforming these kinds of operations into potential profit centers. In the Kearney researchers’ view, this move signifies that these companies’ core business logistics requirements are being addressed, allowing them to utilize and monetize any excess capacity they may enjoy.

In response, previously non-asset-based 3PLs also are choosing to selectively offer services that require a higher degree of asset ownership, by doing things such as adding containers and trailers. These moves have been undertaken to intentionally expand their addressable markets and compete more effectively with asset-based service providers, the researchers believe.

While the prospect can hold great potential gains for each set of players, both 3PLs and shippers need to overcome significant challenges to operate in these new spaces, they add, but eventually could lead to an entirely different approach to logistics management in the future.

“This attempted expansion of 3PL capabilities brings us to the much-discussed concept of 4PL, whose name is meant to convey not so much any idea of ‘fourth-party logistics (4PL)’ but rather the promise of offerings beyond the traditional 3PL model,” the researchers note.

One of the most notable of the practitioners who are pushing the envelope among e-commerce logistics and transportation service providers is in fact Amazon, which is continuing to develop sophisticated logistics services not just for its own e-commerce business but to serve other e-commerce companies as well. What separates Amazon from the other 3PLs is that it is reaching out to control the entire supply chain from manufacturing to home delivery, something no one else has been able to achieve.

“We are increasingly seeing large shippers attempt to monetize their own logistics capabilities—a move that blurs the traditional distinction between them and traditional 3PLs and brokers, some of whom also are adapting by offering asset-based services such as truck fleet management or drop trailers,” say the Kearney researchers.

However, we have not yet succeeded in reaching the halcyon achievement of being able to enjoy a fully functioning 4PL system capable of managing the entire supply chain from sourcing raw materials to last-mile delivery, something that has been predicted to be on the horizon for many years now.

A Good Place to Start: Last Mile

“While no company has yet cracked the 4PL code—though Amazon is coming close and is defining the current state of advancement—several are making some very interesting moves toward rewiring their supply networks,” the researchers observe. “These trailblazers are doing something very smart: looking at their logistical functions as a whole and redesigning them with an eye not only toward cost reduction, but also the unleashing to capacity.”

Although there are not many companies that have achieved this level of innovation, others are on their way to getting there, according to the report. But this doesn’t need to be the goal in the short term, the researchers say. There are many other things that can be done to optimize supply chain management, such as taking steps to optimize parcel carrier cost.

For example, when it comes to last-mile deliveries, the authors hold that shippers should focus this year on building an interconnected multi-carrier network capable of optimizing parcel cost to maximize profitability while not sacrificing customer satisfaction and service levels. To accomplish this, the Kearney researchers recommend pursuing four specific strategies:

1. Increase optionality. With the expansion of diverse carriers serving broad regions, shippers are urged to maintain multiple contracted options when it comes to shopping for the optimal price at the parcel level. “Expanding the carrier portfolio will increase competition and help ensure lower rates, increasing shipper profitability,” the researchers figure.

2. Remain aware of service level offerings. The shipment speeds demanded by customers vary by industry and customer profile. Of course, the general trend is moving towards faster speeds, but shippers should identify areas where general slowdowns may happen, and how to optimize for the right level of service and cost to meet customer standards. They even suggest taking a serious look at technologies that are just coming into their own, like drone deliveries, which after years of hype they believe are becoming more viable.

3. Deploy data-driven negotiation levers. Profitability must be incorporated into all delivery service offerings, with maximum optimization driven by a line-item analysis of accessorial fees and surcharges. To accomplish this, the researchers say shippers should identify the primary cost levers that drive parcel cost rates in their current contracts and negotiate them on a line-item level.

4. Step up the management and optimization of the returns process. Reverse logistics services have become a big deal for a good reason—the cost of dealing with returns has reached the point where they are a significant drain on shipper profit margins. In 2023, e-commerce returns grew to 17.6% of total online sales. “Shippers need to rapidly evaluate ways to manage return demand through enhanced policies and to optimize their return processes to reduce total cost,” the researchers recommend.

About the Author

David Sparkman

founding editor

David Sparkman is founding editor of ACWI Advance (www.acwi.org), the newsletter of the American Chain of Warehouses Inc. He also heads David Sparkman Consulting, a Washington D.C. area public relations and communications firm. Prior to these he was director of industry relations for the International Warehouse Logistics Association. Sparkman has also been a freelance writer, specializing in logistics and freight transportation. He has served as vice president of communications for the American Moving and Storage Association, director of communications for the National Private Truck Council, and for two decades with American Trucking Associations on its weekly newspaper, Transport Topics.