Container Traders Expect Price Increase

In the aftermath of the Baltimore bridge collision, supply chain professionals are anticipating price hikes, as indicated by a significant rise in sentiment for container price increases.

A rebound of freight volumes into the US this year, coupled with the bridge incident and the ongoing challenges in the Red Sea as well as the Panama Canal is expected to strain key US ports in the short term.

The Container xChange's Container Price Sentiment Index (xCPSI) unexpectedly surged from 26 to 61 points between March 18, 2024, and March 29, 2024. This marked increase suggests that the industry is anticipating container prices to increase in the coming weeks—while the suddenness of the index’s move highlights rising uncertainty in the market.

“The sharp rise in sentiment could be linked to ongoing market volatility, the perceived emergency on the US East Coast due to the Baltimore collision, and the resulting sustained pressure on the market.” commented Christian Roeloffs, cofounder and CEO of Container xChange, in a statement.

The company said they have received feedback from industry sources indicating an anticipated increase in container prices in the upcoming days/weeks, with projections ranging from $50-100 per TEU.

US ports under pressure?

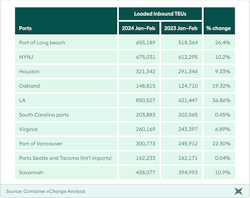

Container xChange's analysis of loaded imports at the top 10 ports in the US reveals a significant increase in container throughput compared to the previous year. This indicates improved port utilization and suggests a strong start to the year in terms of freight demand and activity.

Ports such as the Port of Long Beach, LA, and Port of Vancouver have shown significant increases in loaded inbound TEUs, indicating strong growth in maritime freight traffic.

Now with these diversions, it remains to be seen how well the ports will handle the rise in traffic. As more cargo gets diverted to these ports, we will see an increased throughput pressure on these ports. This could lead to higher congestion and longer wait times for vessels, trucks, and trains at the port.

Given this situation, the company said they expect container prices at these ports to rise in the month of April and beyond, depending on the intensity of the diversions and its aftermath.

The aftermaths of the Baltimore collision are being felt nationwide. New York Gov. Kathy Hochul and New Jersey Gov. Phil Murphy directed their ports Thursday, 28th March 2024, to accept additional cargo to alleviate supply chain pressures from the shutdown in Baltimore. Being the only water route into and out of the port, the shipping channel will be closed for weeks, at a minimum, and possibly for months.

"By February 2024, most US ports experienced a resurgence in loaded cargo imports compared to the same period last year (Jan-Feb volumes in 2023). While volumes have rebounded and port operations have improved, concerns linger due to the ongoing Red Sea crisis and the recent Baltimore bridge collision, which is expected to cause months-long disruptions. This is likely to increase pressure on nearby ports with similar capabilities and may lead shippers and carriers to consider diverting entirely to the West Coast, potentially resulting in additional challenges or even closures for carriers," commented Christian Roeloffs, co-founder, and CEO of Container xChange, an online global container logistics platform, in a statement.

"As we move forward, we anticipate increased wait times and processing fees at the ports where traffic is diverted in the US. The most striking impact, nonetheless, is on the regional supply chain in Baltimore, where the effects on life, the economy, and businesses are severe," Roeloffs emphasized.