State of US Logistics 2019: Collaboration Required to Control Logistics Costs

In the face of skyrocketing supply chain costs, smart shippers and their logistics providers have come to realize that close collaboration is no longer simply a worthy ideal but a vital necessity, according to the 2019 State of Logistics Report from industry trade association Council of Supply Chain Management Professionals (CSCMP).

“The reason that we struck an optimistic tone in the report is because we’ve seen increased collaboration between shippers and carriers, better deployment of technology, and more awareness and desire to solve problems together,” observes Michael Zimmerman, partner with A.T. Kearney and co-author of the 2019 report.

“Whatever happens [to the overall economy] we’re going to see improvements in the supply chain. The silver lining in the clouds is that last year’s crisis really brought logistics professionals and shippers to the fore. They got the ear of the CEO. They’re either in the C-suite or they’re reporting to the C-suite.”

Zimmerman spoke during a panel discussion featuring top shipper and provider executives that took place June 18 at the National Press Club in Washington, DC, following a press conference unveiling the 2019 report, sponsored each year by Penske Logistics, a third-party logistics provider (3PL).

The report took a look back at 2018, which turned out to be a harrowing year for shippers, and concludes that 2019 won’t be much better. “The logistics industry is at a new crossroads,” Zimmerman explains, “It has overcome a tough and exhausting year. Now, demand has softened and growth is in doubt—but not to the point where a steep decline is visible, a context we summarize in the report's title, ‘Cresting the Hill.’”

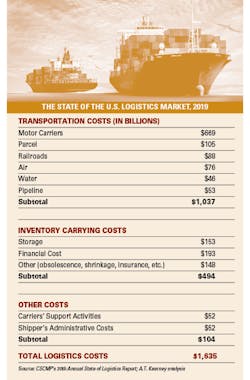

U.S. business logistics costs rose 11.4% in 2018 to reach a total of 8.0% of GDP, a jump of 50 basis points over 2017 (see chart below, “The State of the U.S. Logistics Market, 2019”).

The jump in logistics costs last year stemmed from booming economic growth, low unemployment numbers and high consumer confidence levels. The continued burgeoning of e-commerce consumer demand for fast deliveries of purchases also contributed mightily to pushing up logistics costs.

A closer look at 2018 numbers shows increases across all cost components. Inventory led the way, with a 14.8% overall cost increase on a 4.6% rise in year-over-year inventories in a period when international trade-tension buildups impacted those numbers. Transportation cost increases experienced a 10.4% rise, with trucking seeing a big jump in rates.

Shippers continued to seek less-costly domestic transportation alternatives to for-hire trucking by turning to intermodal and private truck fleets, which grew 28.7% and 13.1%, respectively. In the meantime, U.S. Postal Service revenues also rose 9.7%, making it the big volume winner in last-mile deliveries.

Tackling the Driver Shortage

One key cost factor is the ongoing shortage of qualified truck drivers, which is expected to persist over the long term even as the need for new drivers waxes and wanes with the economy, Ken Braunbach, vice president of inbound transportation for retail giant Walmart, pointed out during the press conference panel discussion.

Increases in truck driver pay (which in the case of Walmart’s private fleet is said to have reached $90,000 a year) and other aggressive recruiting tactics resulted in 50,000 new drivers being added to the industry’s ranks last year, which when coupled with a slight slackening in demand has temporarily settled the driver shortage issue, he said.

Braunbach said his company succeeded in adding 1,300 drivers to Walmart’s private fleet last year. The future is another matter, he warned, noting that the average age of a driver in his company’s 10,000-truck fleet is 57 years old—a demographic truth the rest the industry also struggles with.

Helping their carriers deal with this issue is one way savvy shippers have embraced a collaborative approach, while at the same time strengthening their preferred shipper status with those carriers. Jill Donoghue, vice president of supply chain for Bumble Bee Seafoods, said her company makes sure drivers who pick up and deliver freight have access to clean bathrooms and rest facilities—a persistent driver complaint.

But more important is paying attention to respecting their time by getting them in and out of facilities without extra delays, which her company also does. Braunbach noted that a driver has 660 minutes to drive legally per day. “Anything that we may do that unnecessarily eats into that time is perceived as a negative experience to a driver. We wanted to dissect every milestone that a driver has on our property, whether it’s coming or going, and really found some waste.”

Steven Bobb, executive vice president and chief marketing officer at BNSF Railway, said his company created its RailPASS app to reduce time out of the process for truck drivers who are using intermodal yards. “For the drivers who have been using it over the first 18 months, their typical in-gate experience has been about 10-15% shorter. If you add up those minutes across all of the drivers who come in and out of our facilities, that’s a big number.”

Derek Leathers, president and CEO of nationwide truckload hauler Werner Enterprises, also says electronic logging devices (ELDs) have made shippers more responsive to the need to speed up deliveries and shipments at the dock because they now can more readily perceive the negative impact delays have on drivers’ time.

Not helping is the tangle of new laws and court rulings around the country undermining the independent contractor model that are making it impossible or incredibly difficult to use truck owner-operators. Although opposed by the Trump administration at the federal level, pro-union politicians and judges at state and city levels have been waging constant war on an occupation that has been a recognized part of trucking since the industry was born.

The most prominent of these threats is California’s state Supreme Court decision last year and this year’s legislation making it illegal for a contractor to be in the same line of business as the company they are contracting with, which makes it impossible for an independent trucker to contract with a for-hire trucking company.

“We’re extremely concerned and we’ve essentially ended our independent contractor model completely in California,” Leathers revealed. “What was once 10% of our fleet is now 8% and soon will be 6-7% of our fleet. It is not a point of emphasis going forward simply because the regulations have become way too burdensome. I think it’s a shame because if you look at most of the companies out there that utilize the independent contractor model, it’s really because drivers have aspirations to become business owners over time.”

Marc Althen, president of Penske Logistics, says his company also pays close attention to this issue. “We have weekly discussions with our general counsel on the latest rulings and developments because we do use independent contractors to move some of our loads and we want to make sure that we minimize our exposure. It has big, big ramifications for our industry and we are very concerned about it.”

Collaboration Works

The trucking capacity crunch also has spurred greater collaboration by challenging logistics professionals to think beyond the vicious cycle of shippers forcing truckers to slash rates when there is surplus capacity, and then when capacity tightens carriers simply jack up the rates as high as the market can bear.

In the last 18 months, Werner has taken steps to secure its status as carrier of choice for its customers. “We did not put 20% of our fleet into the spot market and chase really attractive rates. Our rates did not go up as high, and sometimes were significantly less, than the industry average. We stuck by our shippers’ side and we have seen them reciprocate this year, working on a long-term plan,” Leathers revealed.

Donoghue agreed. “What I find that is so interesting and hopeful is the relationship that shippers and carriers have going forward. We’ve been through all of these cycles where it’s a shippers’ market, it’s a carriers’ market, but it feels like after last year we’re truly coming together to collaborate. It’s no longer, ‘You’ve got to reduce your rates.’ Now it’s, ‘How can we work together to be more efficient so that both of us make decent margins?’”

She cited an example of this in the evolving relationship between Bumble Bee and its carriers and truck brokers. They were having trouble with the fluctuating seasonal demand for her company’s products because Bumble Bee had required adherence to year-round rate levels set in advance. “This year we partnered with a few core carriers and basically do quarterly pricing. It’s working out for both of us because we’re not asking them to build in that uncertainty about what’s going to happen in the fourth quarter.”

Donoghue also cited how her company’s relationships with regional 3PL warehouses were transformed by taking a similar collaborative approach. Recognizing that warehouse operators face their own shortage of workers, Bumble Bee moved to a cost-plus model in dealing with its major warehouse providers.

“With that we made sure they were making a good margin and that they were able to hire at a competitive price the labor that they need,” she said. “This is working out really well for us. We’re seeing what the employees are being paid and we’re seeing their productivity numbers. It’s a shared partnership where we are working together to make sure that they get the labor they need, paid fairly.”

Leathers got to the crux of the matter. “It is all about partners who are willing to play a role in mitigating risks for us. We’re there every day trying to mitigate their risks by making sure things are on time, in full and on the shelf. We are working with partners who care about helping mitigate risk for us by creating a sustainable flow of freight so Werner can build efficiencies around it.”

Invited Into the C-Suite

Another development spurred by rises in supply chain costs is the practice of customers’ logistics professionals bringing provider executives in to talk to the customer’s chief executive officer or chief financial officer. “One of our products that we can deliver to our customers is our ability to come in and tell our own story to their CFO or CEO,” Leathers explained.

“We found great value in that last year. We got to understand more about what was keeping them up at night, how and why, and we were able to make our case directly to them on why costs were what they were. That is something we hope to continue.”

Althen said Penske Logistics also finds these regular senior staff-level meetings helpful. “We took a similar approach to our shippers because we were under tremendous margin pressure. We sat down with our customers, showed them open books—this is what we are paying for drivers and equipment. When we see our margins eroding, then we have no choice but to raise prices.”

The A.T. Kearney researchers learned that customers also expect 3PLs to offer a broader range of solutions beyond just warehousing or transportation services, bolstered by a recognizable strength in high-tech capabilities. For example, Braunbach said Walmart needs 3PLs to offer a wider range of services to help deal with a range of modes and shifting needs, as opposed to offering only one kind of service.

This confirmed the researchers’ finding that rising demand and higher expectations from shippers are increasing pressure on 3PLs to actually solve challenges, such as how to optimize logistics operations and how to introduce technology innovations that shippers see as valuable.

For shippers, this kind of talent and specialized insight can be hard to find on their own. Trying to implement the right kind of IT infrastructure internally may not be cost-effective or implementable for them, and an agile culture is something that is difficult to simply adopt.

The 3PL market is split in two, the researchers noted. “Retail shippers want 3PLs to deliver speed and innovation in nontraditional service lines, and the industrial shippers want 3PLs to deliver seamless and cost-effective supply chains. In both flavors, 3PLs are expected to rise above operational support activities to a strategic role that’s expected to have a steadily increasing demand, specifically in the domestic transportation and valued-added warehousing segments.”

Kearney’s Zimmerman strongly believes that the commitment to a collaborative approach is real, it is bearing results and in the future it will become more accepted as a standard approach to managing the supply chain.

“Last year’s crisis raised the stature of logistics professionals and allowed them to invest more time, effort and corporate attention in having better relationships with their carriers,” he said. “I think there has been a shift in the recognition of the importance of logistics and supply chains, which is going to keep feeding that collaboration and bring us better results in supply chains whatever happens in the economy.”