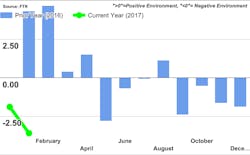

That sound you heard was the window closing on a positive environment for shippers, as tightening capacity sent the Shippers Condition Index plummeting into negative territory. The SCI, a compilation of factors affecting the shippers transport environment compiled by transportation forecasting firm FTR, fell to a -3.6 reading in January. Any reading below zero indicates a less-than-ideal environment for shippers.

For comparisons sake, the previous monthly SCI score was 1.9, meaning means the index dropped by 5.5 points in a month, a rather precipitous decline in such a short period. However, “while capacity is tightening, shippers should be optimistic that regulatory drag will likely be slowed under the new Republican president and Congress,” FTR’s analysis indicates. Even so, solid economic growth forecasts in the 2.5% range for 2017 will most likely lead to increased overall costs for shippers.

“The economy is beginning to show signs of some acceleration,” observes Jonathan Starks, chief operating office at FTR. “Manufacturing is attempting to shrug off its inventory woes, and business confidence has certainly improved, although it hasn’t translated into direct investment yet. If sustained, this would raise the outlook for freight demand this year and into next year. While that would cause capacity to tighten, the tailwind is that the regulatory environment isn’t expected to have as dramatic an impact as initially thought. Costs, especially rates, are still expected to see increases this year after a relatively weak rate environment in 2016."

Meanwhile, analysis of freight shipment data compiled in the monthly Cass Freight Index suggests both that the economy as a whole is getting better and that the overall freight recession (which began in March 2015) seems to be over, according to Donald Broughton, senior transportation analyst with Avondale Partners.

For the month of February 2017, year-over-year freight shipments in the U.S. were up 1.9%, and expenditures were up 3.2%. Since February is typically one of the weakest freight months for most modes of transportation (truck, rail and parcel), the positive trends during the month indicates that the recovery is real, Broughton observes. “We continue to receive almost-daily reports of stronger shipment volumes in all modes,” he adds.

“Part of our growing confidence that the data—both from Cass and specific industries—is showing a turn in trend and is not just a false positive is the underlying trend in inventories at all levels of the supply chain,” Broughton notes. “At the manufacturing, wholesale and retail levels, inventory-to-sales ratios have been consistently falling.” Even as sales are accelerating, he points out, inventories are contracting. “This suggests that a significant restocking throughout the economy could be coming and boosts our confidence in a continued rebound in freight flows.”