A Real-Time Method to Estimate Trucking Market Conditions

Recently, Chris Caplice, executive director of the Center for Transportation & Logistics at MIT, made a thought-provoking argument that, in for-hire trucking, a single "market rate" on a lane does not exist. This makes a lot of sense, especially if one compares rates across shippers, each with their own policies (e.g., payment terms) and relationships with carriers. The price on a lane for a single shipper-carrier combination, however, is typically flat and fixed for a year or two. So while prices across shippers and carriers might not converge to one number, the price across time largely remains the same for a single shipper and carrier.

To an outsider, even this is surprising because while supply and demand conditions constantly change, the prices between the two main parties in the transportation market do not. Many other industries (e.g., coal, petroleum) have adopted market-indexed pricing mechanisms. While trucking is different from pure commodities (network must be considered), there are similarities. For example, there are many buyers and sellers of a common good and little specialization, particularly in the dry van segment.

A precursor to market-indexed pricing is an actual index—and again surprisingly, a real-time, accurate, universally-agreed-upon index does not exist. An index should measure supply and demand conditions in near-real time (e.g., daily), and represent national—or perhaps regional or local—supply and demand conditions. In short, an index should answer the question: As of right now, what is the value of a truck in the market? I recently set out to develop a method that could be used to index supply and demand conditions in for-hire trucking—and the results are pretty interesting.

First, given a good dataset, how might one even go about estimating market conditions? Using spot loads, I propose that an observed price can be broken down into two major components—operational characteristics, such as the lane that it travels on or the pickup day of week, and market status, which is unobservable. If I observe the first two (the price and the operational characteristics), then I can estimate the unobserved market status using econometric techniques. Figure 1 shows this equation—more on "spot price premium" shortly.

Second, it is vital to have a good, relevant dataset. This is not easy to find, as most loads travel at previously contracted prices, which do not vary throughout the year. In order to observe price variation, spot prices are needed. Spot prices have other advantages – for instance, relationships are not dominant when procuring one-off spot capacity in a competitive spot auction. Because relationships are difficult to measure, it is good to be able to ignore them (technically one can even include a variable for every carrier to capture relationships).

Moreover, it is important to have contract prices on lanes that correspond to the spot prices; if a dataset has contract prices and spot prices on the same lanes, then I can define a "spot price premium." I define this as the spot price divided by the average contract price on a lane. For example, if a spot price is $1,000 and the corresponding contract price is $500, then the spot price premium is 2. This is advantageous because it allows me to compare spot prices across lanes and across time.

Finally, I need a sufficient number of spot loads spread throughout time and geography—this ensures that our estimates are robust and not just one-off flukes. So given a sufficient number of spot prices, the corresponding contract prices, and the operational characteristics on all loads, then I can estimate market conditions.

Real-Time, Regionalized Index

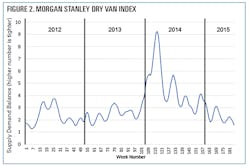

I've had the opportunity to work with a large industry dataset that meets the conditions outlined above. Using this dataset, I've calculated market conditions from 2012-2015. But, how do I know if it's any good? Morgan Stanley surveys a broad array of shippers and carriers to create a measure of supply and demand conditions, published via Transplace's website (www.transplace.com). They have weekly data points, even though it is released monthly. Because this seems to be the best index out there, with interesting variation across time, I used this as a measuring stick for my index. This is only available as a picture, so I converted it using a free web app that digitizes pictures. Figure 2 shows the Morgan Stanley index from 2012 through mid-2015.

- It is real-time—it can be measured as spot bids come in.

- It can be regionalized—if one has spot bids in different parts of the country, supply and demand conditions can be measured separately.

- It can be used to measure the magnitude of actual price swings—for example, spot price changes from one week to the next can be calculated.

Removing Market Inefficiency

So what? I can see this type of real-time index being useful for several parties. First, back to the discussion on market-indexed contracts. A few years ago I worked on a project for a company that operated gas stations. Interestingly, when buying gasoline from producers, the company's trucks simply picked up a tanker full and the price was calculated automatically based on a third-party index. This was easy to do because there is a centralized market for oil. The indexed price ensured that both parties were satisfied: both knew that there was no obviously better option (economists call this a "self-enforcing contract").

While existing shipper-carrier prices are simple in that they do not require negotiation for each load, there is a fair amount of labor that goes into the whole process. Shippers must go through laborious procurement processes each year, line up backup carriers, monitor carrier behavior, replace poorly performing carriers, and procure spot capacity when necessary. Carriers must also participate in many procurement events each year, and decide which loads to accept and which to reject, which must be done (at least) thousands of times a year. And brokering is a highly labor-intensive alternative to "fill the gaps" when shippers need urgent capacity or carriers need loads. In short, market-indexed contracts, in my opinion, could remove a lot of inefficiency in the market.

Moreover, which carriers were happy with their contracted prices in the first half of 2014, when market conditions were greatly in their favor? And which shippers are happy with their prices, well, now, when the market is quite loose? A market-indexed contract could better reflect supply and demand conditions as they change without the need for constant procurement events.

In addition to the players in the transportation industry, this information could be useful for investors. If Morgan Stanley thinks it is worthwhile to create their supply and demand index, then surely there is value in an index that precedes and predicts the Morgan Stanley index. On the surface, it seems that this type of index could be valuable for investors in the transportation market.

Alex Scott is a senior research associate with Opex Analytics (www.opexanalytics.com), a company that applies optimization and machine learning to help solve business problems for its clients. Scott is also a Ph.D. student in supply chain management at Penn State University, and a member of the MH&L Editorial Advisory Board.