Outbound Logistics: Strategies, Performance and Profitability

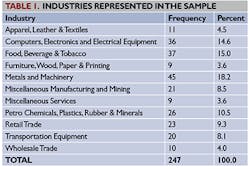

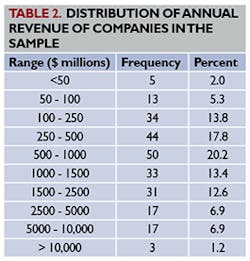

The authors recently completed an extensive analysis of the outbound logistics performance metrics of 247 companies in a broad assortment of industries. This article summarizes the results of this study and its implications for a company's outbound logistics operations and strategies.

Outbound logistics is defined by the Council of Supply Chain Management Professionals as "the process related to the movement and storage of products from the end of the production line to the end user," and it plays a critical role in a supplier's overall customer relationship management process. Retailers hold their suppliers to very stringent product delivery standards. Failure by a supplier to provide reliable service to its retail customers can result in significant financial penalties and even the de-listing (i.e., the elimination) of a supplier's products from a retailer's active product portfolio. Thus, outbound logistics performance represents a major factor in a retailer's decision whether or not to stock a supplier's products, and therefore, also represents an important determinant of a supplier's supply chain and business success.

We explored how different companies and different industries approach and manage the outbound logistics process. For example, we evaluated whether companies can be grouped or classified based upon different, unique outbound logistics strategies. Further, we examined if different outbound logistics strategies contribute to different levels of company profitability. The basis for our analysis and findings is a database of outbound logistics performance metrics and company profitability of 247 companies obtained from enterprise software provider SAP.

Performance metrics provide insights into a company's operational focus and strategy, such as its outbound logistics strategy. Specifically, by evaluating the strength of a company's performance in different operations (via its metrics), one can discern what operations and strategies that company emphasizes. To summarize, our objective was to determine:

- If there are distinct clusters (i.e., groups) of companies which operate with a very similar or shared emphasis on key performance metrics for the outbound logistics portion of the supply chain, and

- What effect, if any, these different emphases have on a company's financial performance.

Supply chain practitioners have a general belief that improvement in outbound logistics should have a positive impact on a company's financial profitability and that there are differences in outbound logistics performance across industries. However, there remains a dearth of rigorous quantitative analysis that provides specific guidance in this area, motivating this research.

On-Time Performance is Key

To best achieve our research objectives, we decided that actual performance data on a set of performance levels and costs for outbound logistics would facilitate an insightful, fact-based perspective. We therefore developed data on a concise set of variables that covered all major components of outbound logistics. For our purposes, we defined outbound logistics as consisting of:

- The management of the inventory produced (to be delivered to the customer)

- The distribution process (i.e., warehousing and transportation)

- The service to the customer (i.e., the actual delivery)

- Capabilities and commitment to demand forecasting and supply chain planning.

Based upon the process and capabilities just defined, we identified the following variables to include in our study:

- Inventory carrying costs [InvCC]

- Obsolete inventory costs [OBSInv]

- Days of inventory on hand [DaysInv]

- Warehousing costs [WHcosts]

- Transportation costs [TRcosts]

- On-time delivery performance [OTD]

- Forecast accuracy [FcastAc]

- Supply chain planning costs [SCPcosts]

Inventory carrying costs, days of inventory on hand, and obsolete inventory costs provide a perspective on a company's costs of inventory, its commitment to having inventory available for customers and how well a company plans its inventory. Warehousing and transportation are two primary components of the distribution process. Thus, from a cost perspective, we thought it important to capture both of these factors. Surveys of supply chain practitioners invariably show that practitioners rate on-time delivery as the most important measure of a supplier's service to a customer. Therefore, we selected on-time performance as the key service indicator to include in our analysis.

Forecast accuracy is a good barometer of a company's capability to perform short-run planning in a key area—matching demand and supply. Additionally, a company's forecast accuracy affects other key plans and decisions such as production and delivery plans. To assess a company's commitment to long-term planning, we selected supply chain planning cost, defined as those expenditures related to developing long-term supply chain plans that include those for outbound logistics. Our rationale for including this variable is that one can consider a company's expenditure level on supply chain planning as a surrogate for the company's commitment to meeting customers' delivery needs.

We also required a ninth variable, namely, the operating margin [OpMargin] of each company. A company's operating margin reflects its profitability after the delivery (and sale) of its inventory to its customers. Operating margin was measured as earnings before interest and taxes (EBIT).

To make the operating margins comparable across the sample, we subtracted the median operating margin for the appropriate industry and year (obtained from Compustat) from the company's actual operating margin to obtain an adjusted operating margin. The adjusted operating margin indicates how much more (less) profitable a company in the sample is with respect to its industry during a given year.

The data for this study were obtained from SAP's benchmarking program for supply chain planning, featuring data collected between 2007-2012 from supply chain managers in various manufacturing and service organizations.

Demographics

Operational Focus

Numerous statistical tests employing methods such as cluster analysis and analysis of variance led to the conclusion that the 247 companies in this study could be classified into four distinct and statistically significant clusters. Specifically, we found that within each group, all the individual companies emphasized similar outbound logistics performance metrics, and therefore implicitly, similar strategies for outbound logistics operations. Based on their operational performance, we named these four distinct clusters of companies as:

The names of these clusters convey the respective outbound logistics operational focus of each of these four groups. Table 3 summarizes the average or mean values for operating margin and outbound logistics metrics for each cluster, and for all 247 companies in total. The following provides a brief summary description of each distinct group.

Cluster 1: Low-Cost, Low-Service Providers

The spending on distribution as a percent of revenue of the 56 manufacturing companies that comprise Cluster 1 is below the average of all companies (4.1% vs. 4.7% for all companies). Additionally, Cluster 1 companies have below average on-time performance when compared to the average for all 247 companies (74.3% vs. the 88.0% average of all companies). On-time performance is a critical component of delivery service, and given the very poor performance in this area, these companies are considered low-cost, low-service providers. Cluster 1 companies also exhibit significantly lower forecasting functionality with an average forecast accuracy of 66.2% vs. the 77.9% sample average.

Cluster 2: Heavy Distribution Spenders

The 22 companies that comprise this cluster spend a significantly higher percentage of their revenue on the combination of warehousing and transportation than do any of the other clusters. The companies in Cluster 2 spend about 7.9% of their total revenue on these two functions, while no other cluster spends more than 4.7% of their total revenue on distribution. The emphasis of Cluster 2 companies on distribution activities results in relatively good on-time performance (90.5%) by these companies.

Cluster 3: Planners and Efficient Distribution Spenders

This cluster of 48 companies exhibits the lowest level of spending on distribution (as a percentage of revenue) of any of the four clusters. Cluster 3 companies average 3.8% of total revenue spent on distribution compared to an overall average of 4.7% for all companies. These companies spend the lowest percentage of their revenues of any cluster on transportation (2.4%), and a below average percent of their revenues on warehouse operations (1.4% vs. 1.6% overall average).

At the same time, the companies in Cluster 3 spend twice as much on supply chain planning (as a percentage of revenue) as compared with the overall sample average. Given this combination of relatively low distribution spending, coupled with a strong emphasis on planning, we call these companies planners and efficient distribution spenders. There is evidence that this emphasis on planning contributes to the outbound logistics execution of Cluster 3 companies as they exhibit the best on-time delivery performance (92.3%) of the four clusters.

Cluster 4: Inventory Investment Minimizers

The 121 companies in Cluster 4, the largest of the four clusters, have the lowest levels of obsolete inventory (4.2%) expressed as a percentage of revenue. Cluster 4 companies also have the lowest inventory carrying costs expressed as a percentage of revenue of any cluster (1.2% vs. 2.0% average for all companies). Further, Cluster 4 companies' average of only 46 days of inventory on hand is lowest among all clusters and is significantly less than the overall average of 64 days among all companies. Overall, all three inventory management metrics indicate that the companies in Cluster 4 focus more on minimizing inventory investment than do companies in the other three clusters.

Interestingly, Cluster 4 companies have the second best on-time performance (92.1%) of any cluster and these companies also display the highest level of forecast accuracy (83.1%). Finally, these company's expenditures on distribution (4.68% of their revenues) is almost identical to the average distribution spending of all companies (4.66%).

As shown in Table 3, the mean adjusted operating margins of the four clusters range from a high of 5.6% for Cluster 3 (the Planners and Efficient Distribution Spenders) to a low of 3.4% for Cluster 4 (the Inventory Investment Minimizers), a difference of 65%. The operating margin across the entire sample is 4.2%, and so the differences of cluster 3 and 4's means appear substantial. However, from a rigorous statistical perspective, analytic results indicated that the differences across cluster means is not statistically significant. The relatively high standard deviation of operating margins within each cluster relative to their means appears to be a major contributor to this result. These results suggest therefore that there is no one unique outbound logistics strategy that will yield a higher level of profitability.

No Single Approach Is Superior to Another

Our analysis indicates that different groups of the 247 companies in the study emphasize different operational and planning priorities. The Inventory Investment Minimizers, the largest group representing about 49% of the sample, focus on tightly controlling their inventory investment, carrying and obsolescence costs. The second largest group, the Low-Cost, Low-Service Providers who comprise 23% of the sample, focus on maintaining low distribution costs and sacrifice on-time service levels in doing so. The Planners and Efficient Distribution Spenders, 19% of the sample, invest more resources on supply chain planning activities and this allows them to provide superior on-time delivery service at relatively low costs. The smallest group in our sample (9%), the Heavy Distribution Spenders, as their name suggests do spend heavily on warehousing and transportation, and this results in good on-time delivery service.

Tan Miller is director of the Global Supply Chain Management Program at Rider University's College of Business Administration, and a member of MH&L's Editorial Advisory Board. Matt Liberatore is a management professor at the Business School of Villanova University and the director of Villanova's Business Analytics Center.

The authors would like to express their appreciation to David Kargman, Jack Schmidt, Rick Wenger, Katharina Muellers-Patel and Jakub Wawszczak of SAP for their assistance in obtaining the data for this study.