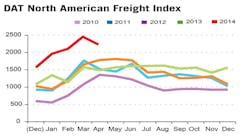

April saw a leveling of truckload demand in the spot market after a robust first quarter, according to the DAT North American Freight Index. Extreme weather, as well as economic and regulatory factors, reduced fleet productivity and disrupted supply chain operations throughout the winter, driving a larger proportion of shippers and intermediaries to the spot market for elusive truck capacity.

Higher Volumes

Spot market freight volume remained well above historic norms in April, up 51% compared to the same month in 2013. Freight designated for vans, the predominant equipment category, was up 48%, refrigerated (“reefer”) freight increased 53%, and flatbed freight saw a 66% increase, year-over-year.

Compared to the record-breaking levels of March, however, total freight volume slipped 8.8% in April. A decline from March to April has occurred twice in the last five years. Month-over-month, April van and reefer freight volume contracted 22% and 25%, respectively. Flatbed loads increased 10% month-over-month, however, in an expected seasonal pattern.

Higher Rates in 2014

Significant year-over-year rate increases accompanied the unusually high volume for all three major equipment types. Rates rose 19% for vans, 20% for reefers, and 12% for flatbeds, compared to April 2013. Month-over-month, however, van rates declined 3.8% from record highs in March. Rates rose 2.3% for reefers and 4.0% percent for flatbeds, due to strong seasonal trends that affect cargo availability for those equipment types.