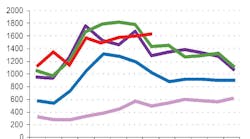

Spot market freight volumes rose 0.5 percent in July, exceeding June levels for the first time since the DAT North American Freight Index started reporting these numbers in 1996. Freight volume typically declines from June to July; the average month-over-month decline was 20 percent over the past ten years.

This year's atypical, extended freight season can be attributed to a combination of pent-up demand for flatbeds due to weather-related delays in housing starts, as well as a robust harvest that added to July demand for refrigerated ("reefer") trailers in the West and Midwest, DAT analysts report. Flatbed loads increased 6.0 percent and reefer freight availability rose 1.8 percent, while van loads declined 6.2 percent compared to June.

Year-over-year freight availability rose13 percent overall, with increased volume for all equipment types. Flatbed volume rose 20 percent, reefer loads increased 26 percent and van freight added 6.8 percent compared to July 2012.

A seasonal month-over-month decline in spot market rates is expected in July, as capacity becomes available in many parts of the country. Rates rose 1.2 percent for flatbeds, however. Rates declined seasonally for other equipment types, dipping 0.7 percent for vans and 3.4 percent for reefers, as additional truckload capacity became available to meet seasonal demand. On a year-over-year basis, flatbed rates declined 6.7 percent and van rates slipped 2.1 percent from the record highs of July 2012, but reefer rates rose 1.2 percent.