Activity-based costing (ABC) has helped many companies for decades gain a true understanding of their costs to produce and distribute products to customers. ABC provides a precise, accurate view of costs at very granular levels—namely, at the individual product, service and customer level. As we will discuss, this differs from traditional accounting systems that are best suited to generate cost analyses at the overall firm, function and facility level, but which distort costs at more granular levels such as the individual product or customer level.

ABC receives relatively little attention in the world of logistics today, where such forces as the rapid advance of technology, the growth of e-commerce and the rise of omni-channel dominate headlines and corporate resources. However, ABC remains a critical foundational tool that represents an absolute necessity to ensure a company can accurately understand its true costs to serve customers. In this article, we revisit this essential decision support capability.

What Is Activity-based Costing?

ABC first gained prominence in the corporate world during the 1980s as a new methodology that allowed manufacturers to accurately capture their true costs to produce individual products. Two of the original developers of this approach, Robert Cooper and Robert Kaplan, described this methodology in a 1988 seminal article titled, “Measure Costs Right: Make the Right Decisions.” These authors argued that because traditional accounting systems proportionately allocate a manufacturer’s overhead costs based upon gross measures such as the total dollar sales of each product produced, this results in distorted individual product cost calculations. (Indirect overhead costs are expenses such as heating, lighting and supervisory management. In manufacturing operations, note also that direct labor costs, direct labor hours and machine hours associated with producing individual products are other common “bases” or “drivers” for proportionately allocating overhead costs.) Further, when companies use aggregate measures to proportionately allocate costs such as marketing and distribution to individual products, the potential for major distortions in product costing dramatically increases.

Successes during the 1980s in applying ABC methods to manufacturing prompted an eventual expansion of this methodology to other key components of the supply chain (e.g., distribution). Manufacturers such as Proctor & Gamble and Warner-Lambert began using ABC models to determine their overall costs to serve individual customers (e.g., Walmart), and to evaluate the costs of offering different individual services to customers (e.g., services such as vendor-managed inventory and advanced shipment notices, or ASNs). To illustrate how ABC contributes to a company’s understanding of distribution and other related costs, let’s consider the following example where a company is evaluating the profitability of its three major distribution channels.

A Distribution Channel Profitability Example

Assume company XYZ is a manufacturer and distributor of pharmaceutical and consumer products, and it sells its products through three primary distribution channels: mass merchandisers, wholesalers and small retailers. Now let’s evaluate the overall profitability of each channel based upon: 1) a traditional accounting system, and 2) an ABC system.

Assume that XYZ’s traditional cost accounting system allocates its distribution center’s (DC) costs based upon either the total dollars or weight shipped to each customer and channel. Typically customers, channels and products do not consume DC resources (such as labor and machine time) proportionately to their dollar or weight volume, so a traditional cost accounting system will distort the true costs.

Now suppose the XYZ DC distributes a mix of low-valued to high-valued products with a wide range in the dollar value per pound, and it receives, stores and ships products in everything from individual eaches (e.g., pharmaceuticals) to pallet quantities (e.g., bulk consumer products). In addition, assume there are small pick lines (for eaches), automated conveyor lines (for cases) and forklifts (for bulk pallets) to move product from inventory storage to the shipping dock. Finally, there is a separate pick area to serve the special requirements of the three largest customers, and all modes of transport are used, from truckload to ground parcel to next-day air. An ABC view of costs at this facility would differ substantially from that of a traditional aggregate volume-based perspective.

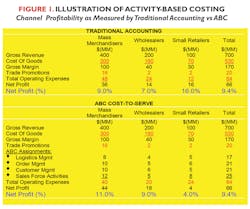

Figure 1 shows the difference in the net profit generated by the three different distribution channels as calculated by traditional volume-based accounting and then by an ABC approach. In contrast to the volume-driver-based accounting system that uses only sales dollars to allocate costs, XYZ’s ABC system employs many more drivers. For example, the DC may use a case pick operation to serve small retailers and a bulk pick operation to serve wholesalers and mass merchandisers.

The ABC system would accurately calibrate the different costs of serving customers using the two different operations. It also would evaluate the costs of all other major components (such as order management, transportation and sales force activities) involved in serving customers.

In this fictitious case, one can observe that based on the ABC costing system, the small retailer channel provides the smallest profit margin (4%), while the mass merchandise (11%) and wholesale (9%) channels yield a higher return. Conversely, the traditional costing system incorrectly indicates that the small retail channel generates the highest profit margin (16%), followed by the mass merchandise (9%) and wholesale (7%) channels, respectively.

Note that in the traditional system, XYZ’s $84 million total annual operating expenses are allocated to each channel based upon that channel’s proportion of total gross revenue (e.g., the small retail channel’s operating expense equals 100/700 x $84 million). This gross allocation of operating expenses distorts XYZ’s cost to serve each channel.

This example illustrates the alternative, more accurate cost and profitability insights that a good ABC system can generate, and the dangers of making decisions without an ABC system.

The ABC Models behind ABC Systems

To develop an accurate ABC system, a company must first develop a good process model of the activity or operation of interest. XYZ requires that its ABC system capture how its costs to deliver products to each customer differ. At the minimum, therefore, XYZ must create ABC models of its DC operations and transportation delivery processes.

Further, as Figure 1 illustrates, XYZ is evaluating its costs by customer (and distribution channel) in terms of sales force activities and customer service. In practice, this would necessitate that XYZ construct and maintain process models of each of these major components of the order-to-delivery process. For illustrative purposes, we briefly consider DC operations which represent one of the key activities of this overall process.

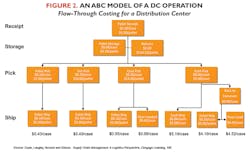

Figure 2 illustrates the process and cost model that XYZ would maintain of this operation. A team of DC operations and accounting/finance personnel would develop the process flows and cost analyses necessary to generate this model.

A review of Figure 2 shows that the cost per unit (i.e., per pallet, case or each) of every activity is calibrated. XYZ can combine this DC ABC model with its databases that provide data on how many cases, pallets and eaches its DC picks and ships to each customer, in order to assess the costs XYZ incurs in serving each of its customers from the DC. XYZ would need similar models of the other major activities (e.g., transportation) utilized in serving its customers.

Collectively, these ABC process models would facilitate XYZ’s evaluation of the true cost to serve each customer.

ABC Is More Critical than Ever in Logistics

Omni-channel and the business to consumer delivery process represent one of the most dynamic, rapidly evolving areas of logistics operations. Further, the escalating competition that B2C suppliers face to provide same-day or near-same-day deliveries to consumers (often with no delivery fee) places many suppliers under severe cost pressures. Business-to-business suppliers similarly face ever-increasing service demands and cost pressures, and many suppliers now compete in both the B2B and B2C worlds.

To compete today, and to design efficient, profitable delivery strategies for tomorrow, demands that suppliers accurately know their costs to deliver every product to every customer. Suppliers managing without this essential information have little hope of designing and executing efficient and effective delivery network strategies and operations. Only suppliers armed with an accurate, ABC-based view of their delivery costs at the individual product and customer levels can successfully compete in the long run.

Final Takeaways

It is beyond the scope of this article to review in detail development and implementation strategies for ABC systems. However, there are several key takeaways we will address in closing, and we offer additional references for the interested reader.

• First, it is important to note that ABC costing systems are intended to complement traditional accounting and financial systems, and should not be viewed as replacements or threats to a company’s existing systems. Rather, ABC systems facilitate detailed insights on a company’s true cost to serve individual products, to offer specific customized customer services, and so on.

• It is imperative that an ABC system utilize the same underlying data and database sources as the other accounting systems of a company. ABC systems will employ the data differently and may have additional input sources than do the traditional accounting systems; however, the “total costs” of the two systems must be identical. In other words, any cost analysis generated by an ABC system must align with a company’s financial reporting system at an “aggregate level.” As illustrated in Figure 1, individual cost analyses (such as the cost to serve different distribution channels) will differ between the ABC and traditional accounting systems. However, at the aggregate total operating cost level, the systems must agree.

• To develop ABC models of its operations, a company should utilize operational colleagues working with accounting/finance colleagues in a team-based approach. For example, to construct an ABC model of a distribution center, the project team should include several DC managers, as well as other logistics and accounting personnel.

• Commercial software is available to facilitate the development and deployment of ABC systems, or alternatively a company can develop its own ABC models to complement its existing accounting systems.

To conclude, in the rapidly evolving world of 21st century logistics, it is more critical than ever for companies to invest sufficient resources in the well-established, foundational decision support capability that an ABC system provides.

Tan Miller is director of the Global Supply Chain Management Program at Rider University (www.rider.edu), College of Business Administration, and is a member of MH&L’s Editorial Advisory Board. Previously he worked in private industry for over 20 years where most recently he was responsible for the operations of J&J’s U.S. Consumer Distribution Network.

References

Chea, A.C., “Activity-based Costing System in the Service Sector: A Strategic Approach for Enhancing Managerial Decision Making and Competitiveness,” International Journal of Business and Management, 6:11 (Nov., 2011).

Cooper, R. and Kaplan, R.S., “Measure Costs Right: Make the Right Decisions,” Harvard Business Review, 66 (Sept.-Oct., 1988).

Liberatore, M.J. and Miller, T., “A Framework for Integrating Activity based Costing and the Balanced Scorecard into the Logistics Strategy Development and Monitoring Process,” Journal of Business Logistics, 19:2 (1998).