Now is the Time for Supply Chains to Invest in Innovation

Innovation is the driving force behind the competitive landscape.

A study from McKinsey in 2021 found that 84% of executives say innovation is the key to growth. That same survey found that the top 10% of companies earned almost twice as much from products that didn’t exist the year before.

Investing in innovation is complicated, however. To help companies navigate this, an inaugural measurement from Kearney called the COO Innovation Radar examines the “complex, expensive, and risky endeavor of pursing breakthrough innovation."

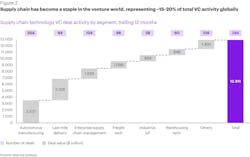

The report notes that the supply chains sector remains an investment priority for the technology community and is now a staple of the VC market. The survey notes that according to PitchBook, investments in supply chain startups increased 12%-15% of the VC market during the pandemic. This resulted in $15.4 billion of funding in 2023.

Investment in technology that enhances predictability and visibility is prevalent. Other technologies that are seeing investments include advanced analytics, real-time tracking technologies that enable precise forecasting, proactive issue resolution and transparency from production to delivery.

As a percentage of investment, 50% of the total is going toward last-mile delivery and autonomous manufacturing.

Analyzing the data with regard to the ROI of top performers, the survey found that logistic technology uses cases deliver the highest returns. The highest ROI was for IoT in smart digitalized lockers and last-mile storage. The next highest returns were from adding automation to vehicle fleets. And third was applying AI and ML to automatic delivery status tracking and predictive delivery times. Other strong ROIs come from automative guided vehicles, collaborative robots and material conveyance.

MH&L asked Evan Gutoff, Partner and Global Head of Foresight and Innovation in Kearney’s Digital & Analytics practice for further analysis.

MHL: Although the US seems to be moving up on global surveys on innovation, should this be a priority for US companies, especially as it relates to the supply chain?

EG: Innovation is not just a priority; it is a necessity for U.S. companies, particularly within the supply chain domain. The U.S. is leading the world in AI research and development, according to S&P the US private sector has invested more than three times as much in AI than any other country did from 2013 through 2023 with many of the leading, cutting-edge companies in predictive analytics, intelligent automation all being built in the U.S.

Sorting through this plethora of solutions, however, is hard, and many companies fall for the 'adverse selection' trap when confronted with so many options. Being able to sort through the noise and leverage access to these technologies separates leaders from laggards in innovation ROI.

MHL: Given the weak economy this year and forecasts for next year, how realistic is it that companies feel they can afford to make investments in technology for the supply chain?

EG: In challenging economic environments, the natural instinct for many companies is to tighten their belts and delay investments. However, our study found a clear, pronounced relationship between how active companies are at exploring and testing new technologies and the bottom-line impact they are able to drive from said technologies.

Investing in technology now—especially in areas like AI-driven demand forecasting, automation, and real-time data analytics—can provide companies with the agility and resilience needed to not only survive but thrive in a downturn. Additionally, these investments often pay for themselves through cost reductions, improved service levels, and enhanced operational efficiency, making them not only realistic but essential for long-term success. And critically, companies will be strengthening their innovation muscle, making it easier to scale innovation efforts over time.

MHL: If companies decide to invest, should this come under a different structure of philosophy than past technology investments?

EG: One thing that we see frequently in the market, and is supported by our survey, is that being active in the innovation ecosystem and running large numbers of experimental pilots is the recipe for success in adopting new breakthrough technologies. Rather than focusing on huge multi-year mega projects, innovation leaders have built muscle around identifying, testing, and then scaling interesting technology use cases within their supply chains.

This is a totally different strength, and many large corporate clients find they don't necessarily have the talent, access, or processes in place to be able to innovate in this way. But building this capability over time is critical to long term success.