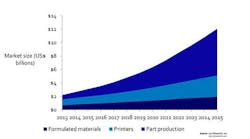

The total 3D printing (3DP) market will nearly quadruple to $12 billion in 2025, according to Lux Research. The technology is being driven by growth in diverse industries including aerospace, medical, automotive, consumer products, architecture and electronics. Breaking that market down, printers alone will be worth $3.2 billion, while $2 billion will represent formulated materials and $7 billion will come from the value of parts produced.

“Consumer uses of 3D printing attract most of the headlines, but industrial uses, from molds and tooling to actual production parts, are quietly having the greatest impact,” said Anthony Vicari, Lux Research Associate and the lead author of the report titled, “How 3D Printing Adds Up: Emerging Materials, Processes, Applications, and Business Models.”

“However, the field is still just getting started; advances in processing and printable materials technology are still necessary for future growth,” he added.

Research analysts developed a model incorporating industry-specific material and market requirements, historical adoption rates of new materials, and inputs from interviews with nearly 100 entities throughout the 3D printing value chain. Among their findings:

- Razor/blade model is a hurdle. Much like conventional "2D" printer makers, 3D printer companies often sell formulated materials at a steep mark-up – 10 times to 100 times. This approach was tolerable when companies only used 3D printers for prototyping, but it remains a major impediment to the use of 3D for production parts, as leaders such as 3D Systems, Stratasys, and EOS restrict third-party materials suppliers from entering the market.

- Four printer companies dominate the market. On the Lux Innovation Grid, only four printer companies placed in the “Dominant” category, based on technical and business scores. They are: 3D Systems, Stratasys, EOS and Arcam. The four hold a combined 31% printer market share. Of these, Arcam is distinguished by its open materials supply model. Among independent materials suppliers, a clutch of companies – Raymor Industries, Taulman 3D, Made Solid and Ceralink, among them – offers “high potential,” but none is dominant.

- Expiring patents will trigger growth. In 2006, expiration of several early patent families enabled the emergence of lower-cost desktop printers from companies like Makerbot, as well as consumer-facing 3DP services like Shapeways, raising popular interest in the technology. An even bigger shift is coming as patents on other key 3D printing technologies start to expire over the next three years, lowering costs for those methods and widening the range of capabilities available to users.