By the time 2012 ended, manufacturing and distribution professionals had reason to be conflicted. For many of them business was up and leading business indicators promised that an additional slow but steady lift was coming in 2013.

This being a group that thrives on being well informed, however, they also know the threats they face. These include fragile consumer demand, continuing legislative/regulatory pressures, unpredictable oil/energy prices, decreasing margins and increasing wage pressures.

See Also: Supply Chain Technology & Automation Trends

These pressures shaped the responses to an MH&L reader survey we conducted last month seeking trends in conveyor system applications. More than half of the respondents indicated they were enjoying between 5-10% business growth compared to last year at this time. Nevertheless, two-thirds of them are at least mildly concerned about another recession and almost a third are very concerned.

On the optimistic side, 40% expect the same 5-10% growth in 2013 and 15% expect growth of 10% or better. Although another 15% expect a business decline, the remaining third expect flat terrain.

Those with negative assessments about 2013 business prospects had similarly pessimistic feelings about U.S. tax policy. The expected effects of these policies include lower profits, spending cuts, hiring freezes, staff cuts and pay cuts—in that order. Forty-two percent expect all of these although 17% of all respondents don't expect any of these.

Iffy Spending Plans

All of this translates into a predominant "wait-and-see" attitude toward investment in material handling improvements this year. Seventy-two percent don't plan on any system improvements, indicating they're waiting for better economic stability. Those who do plan on investment cited a mix of conveyor, forklifts and robotics. Two respondents, both third party logistics service providers, exemplify industry's mixed emotions about their economic outlook: "I'm concerned that policies on a national level are creating uncertainty in the marketplace which is causing people to not feel comfortable with long term spending," said one. "For our particular business, this is the first time we're making a commitment to truly invest in [capital improvements], so we believe the 3-5 year future is bright!," said the other.

Adaptability by Conveyor

This flexibility in economic outlooks is a good place to start our look at conveyor trends in the next few years. Conveyors, by the nature of the latest technology, are flexible. The newest offerings are modular and easily adaptable to changing business conditions.

That said, according to MH&L's survey, much of what's out there is pretty mature. Forty percent of the respondents indicated their conveyors are between 5-10 years old, and more than a quarter of respondents have conveyors older than that. As for the kind of applications for which these conveyors are deployed, it's a pretty even split between manufacturing and distribution. Almost a quarter are used for both.

This finding didn't surprise Brandy Lloyd, systems engineering manager for Hytrol Conveyor Co. (www.hytrol.com), but he senses a change coming where manufacturing and distribution are concerned.

"We've seen an increase in manufacturing projects over the last year," he says. "We are also seeing a trend with companies investing in smaller DCs and having them in more locations to meet the commitments of same- or next-day delivery."

Although "wait-and-see" characterizes most short term conveyor investment plans, 43% don't expect to hold out for long. They'll get up off of their wallets within 1-5 years, they said. However 22% expect to make best use of what they have for at least another decade.

Maintaining Existing Equipment

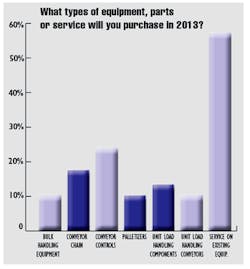

Of those planning investments, 63% involve retrofits, indicating a bent toward improvement rather than renovation. A third will be spending less than $5,000 on material handling equipment in general this year. A little more than 15% will invest between $50,000 to $100,000. Almost a third fall between $5,000 and $50,000. The remaining few will spend more than $100,000.

More than two-thirds expect their material handling equipment budget to be about the same next year. Where conveyors are concerned, 45% don't anticipate any investment in equipment or services. Of those who do have plans, a third amount to less than $10,000. And for most, their spending on conveyor won't change much from last year.

E-Commerce Setting the Pace

Where users are spending on new equipment, it's to create a system layout that's faster and easier to change. Ruehrdanz says implementation teams can configure a system using standard pre-engineered conveyor modules (see image on pg. 22), showing a steerable wheel sorter, representing a standard "plug & conveyor" module).

This system trend matches the business trend toward the need to handle a wider variety of product configurations, as driven by growth in e-commerce.

"Companies are looking to upgrade their systems to be more efficient and convey a wider range of product," says Lloyd. "Light weight product and polybags are becoming very common."

This is making segmented belt on roller a popular option, according to Ruehrdanz.

"This enables non-contact and precise control of items to be conveyed," he says. "Segmented belt on roller conveyor more effectively accommodates light weight loads and polybags."

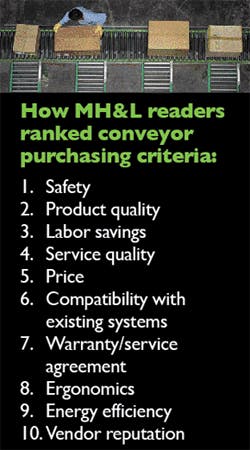

Safety and Quality are Tops

Where speed and volume go together, so do safety and quality. In fact safety and quality are the most important criteria in a conveyor purchase, respondents told MH&L. These are followed closely by compatibility with existing systems and service quality—which seem to support the desire for continuous system improvement. What surprised Lloyd about these responses was that price was not in the top three—and that ergonomics was even lower.

"Quality is always first on the list when customers are looking to purchase but I'm a bit surprised that price was further down the list," he says. "I feel companies are still watching their spending very closely and they want to invest in the best product for their budget. In my opinion safety and ergonomics go together—safe and functional products and solutions."

Conveyor trends are giving users more control of safety and functionality by improving operational visibility, says Ruehrdanz.

Visibility and Wear Control

"Providing operational and maintenance support is more efficient with diagnostic tools," Ruehrdanz notes.

"Plug-in human-machine interface modules allow maintenance personnel to change operating parameters or perform diagnostics on local conveyor controls."

Energy efficiency was another high priority for respondents, which explains why manufacturers are offering automatic speed control as an option with their equipment. This reduces both energy costs and wear.

"In a sliding shoe sorter, for example, we look at components that reduce the amount of drag, wear and friction," says Balzer. "It's also about choosing the motor appropriately then running it as slow as you can because the less speed, the less energy you draw. That becomes about better gapping and better carton control to give the system as much capacity as possible."

Hybrid systems offer a mix of low voltage DC motorized roller conveyor modules with standard AC drive technology.

"By applying each technology where it performs the best, users obtain the best performance each technology has to offer," Ruehrdanz adds.

Service is the Hottest Product

The ability to make best use of people as well as technology is especially important to those respondents expecting hiring freezes, staff cuts and pay cuts. That means their priority this year has to be better labor management.

Conveyor manufacturers are following that trend as well and are shaping their service offerings accordingly. For example, Intelligrated's I-Watch sorter maintenance software can track equipment cycles and on and off time to give the customer's maintenance team better visibility to what's going on.

"The chain is critical to the sorter so we added the capability for our control system to post performance of the chain lubrication system for our customer service team," Balzer says. "Our customers get the same information via e-mail alerts with alarm conditions that say something isn't right. The idea that resonates with them is that their maintenance teams are able to get notified in real time."

In this age of uncertainty and shortages of skilled labor, service is comfort food for customers in every industry.