Today’s manufacturing and distribution operations face unprecedented competitive pressures, with a challenging labor market, rising commercial real estate costs and e-commerce growth all coming together to mandate greater efficiency. In the quest to make the most of available resources, companies are investing in automation, adjusting workflows, collecting data and more.

But what about lift truck power?

The right lift truck power choice can go a long way in improving operational efficiency. For example, different power sources place varying burdens on labor to replace, charge or refuel; they require disparate amounts of space to house refueling, charging and changing infrastructure; and they come with different upfront and long-term costs.

Here are six signs your operation may need to reevaluate lift truck power.

1. Substandard Productivity

Managers build and balance lift truck fleets to meet critical operational goals. But what if the actual output does not produce enough to meet demand?

The answer may lie with a labor-intensive power source, or one that has declining levels of productivity. For example, some batteries no longer supply full power once they reach 50% depletion. This can cause operations to only function at full capacity for half the time. Or, operators may spend too much time engaged in complex charging and time-consuming changing procedures. This hits operations two ways, with management not only facing declining productivity, but incurring costs for non-productive activities.

2. Excessive Power Source Inventory

One of the worst scenarios for a lift truck fleet is insufficient equipment to serve demand. Or worse yet, lift trucks left idle due to a lack of available power sources, leaving operations unable to handle mission-critical tasks. But accumulating excess power sources on redundant equipment comes with downsides, taking up more space in already tight footprints and pressuring already strict budgets.

How do operations know the right balance? If the ratio reaches two or more power sources per lift truck—whether because of reliability or short usage periods—then the time is right to evaluate other options. At that point, the cost and space disadvantages of carrying that many extra power sources are too great.

3. Not Enough Space

Operations must find additional storage room in a real estate market where the cost of commercial and warehouse space continues to rise. In the search for greater capacity, managers are under pressure to reexamine how existing space is used.

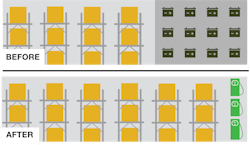

Some power sources require fueling infrastructure that can be located outside, leaving indoor space available for revenue-generating operations. However, some power options require significant indoor space for storage, charging and changing. For example, lift trucks in a three-shift, 24/7 application using lead-acid batteries require up to three batteries per day, with a constant cycle of one in use, one charging and one cooling. Similarly, liquified petroleum gas (LPG) requires one tank per shift, accumulating the same two excess power units for a three-shift application, but also requires additional space for empty tanks awaiting exchanges.

While some operations may assume occupying this indoor space or carrying excess sources is simply a cost of doing business, reevaluating lift truck power can allow them to reclaim a significant amount of space for core operations (see Figure 1).

4. Declining Labor Efficiency

Good help is hard to find—and even harder to keep. Record low unemployment means operations must make the most of what labor they do have, but complex battery maintenance, charging and replacement processes to simply power lift trucks take a big bite out of labor productivity.

How big? Removing a spent lead-acid battery and replacing it with a fresh one often takes 15-20 minutes, or even longer if operators have to drive a distance or wait in line. On top of that, many operations maintain complicated charging schedules to avoid utility cost penalties during peak hours.

It does not have to be this way. Some sources allow refueling in as quick as three minutes or charging whenever operators have a free moment and access to a standard outlet.

5. Premature Failures or Equipment Rentals

The true cost of a power source extends far beyond the initial acquisition cost. Various sources require extensive fueling and charging infrastructure, and utility costs can rapidly accumulate. Premature failure can also leave operations on the hook for replacement costs as poor battery charging habits and engine maintenance can lead to unfulfilled warranty claims.

To get the full value from the warrantied cycles out of a lead-acid battery, operators must use the full available charge and then recharge to 100% capacity. Failure to do so, such as charging over a lunch break from 45% to 52%, counts as a cycle and risks adverse effects—reducing battery longevity and capacity. But that’s not all. As lead-acid batteries degrade near the end of a shift, the truck overcompensates the lack of power by discharging extra heat, unnecessarily straining the motors, chassis and hydraulics.

To make up for fleet limitations, some operations accumulate more unplanned costs by renting forklifts to cover peak periods. This equipment redundancy accumulates added expense, takes up additional space and can be rendered unnecessary by simply having existing trucks fully-powered for the entire shift.

6. New Regulations for Emissions and Hygiene

Certain states have stricter emissions and health regulations than others. The challenge is to maintain performance while avoiding fines and other sanctions. Furthermore, certain industries—like food, beverage and pharmaceutical—are subject to their own strict hygiene standards, including airborne contaminants. And last but not least, corporate requirements for sustainability often come top-down, leaving managers to find ways to actually implement on the ground.

What are the sources of these potentially compliance-busting contaminants? Internal combustion engines—diesel, gas, LPG—are the usual suspects, but perhaps surprisingly, all electric options are not squeaky clean. As part of regular maintenance, lead-acid batteries require off-gassing, which can contaminate sensitive products and violate emissions standards.

Where to Go from Here?

The lift truck power source market is more robust and diverse than ever, with newer technologies like thin-plate pure lead batteries, hydrogen fuel cells (Figure 2) and lithium-ion batteries that are now proven in the field. The market now offers unprecedented choice alongside traditional lead-acid batteries and internal combustion engines.

Making the right decision requires analyzing the unique requirements and competitive pressures facing each operation. The right partner has expertise in lift truck applications and all available power options but no allegiance to one over another, enabling a decision that considers the broadest range of power options based purely on operational needs.

Kevin Paramore is the emerging technology commercialization manager for forklift manufacturer Yale Materials Handling Corp.