Most Companies Will Pass on Tariff Costs

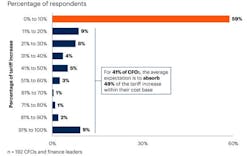

The question of what companies will do with regard to new tariffs has been agonizing. However, 59% of CFOs have decided and expect their organizations to absorb less than 10% of tariff impact in their cost-base. This is according to a survey from Gartner.

The survey also found that 41% expect to absorb on average 49% of tariff increase within their cost base.

Gartner polled 192 CFOs and finance leaders from a cross-industry group of organizations with global operations about priorities in response to new tariffs.

“CFOs are strategically responding to new tariffs, focusing on cost management and supply chain adjustments to mitigate the financial impacts.” said Alexander Bant, chief of research in the Gartner Finance practice, in a statement. “While a majority of CFOs are not expecting their organizations to absorb most tariff related costs, some do, likely indicating varying levels of price sensitivity among customers and suppliers for specific organizations.”

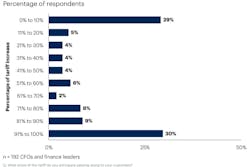

The planned response to tariffs by CFOs is most noticeable in the potential impact to customers where 30% of respondents are planning to pass 91%-100% of tariff costs and 29% intending to pass on 10% or less to consumers. The average pass-through to customers is about 73% of the tariff increase .

“CFOs are exploring various strategies to minimize the short-term impact of tariffs, including revisiting Harmonized Tariff Schedule (HTS) classifications, leveraging tariff exemptions and free trade areas, and optimizing transactional structures to lower the dutiable value of imports,” said Bant. “Despite these efforts, 45% of CFOs have no immediate plans for tax and duty compliance adjustments, potentially overlooking quick wins.”

In terms of financial strategy, CFOs are prioritizing updates to financial risk assessments, enhancing forecasting and scenario planning capabilities, and adjusting pricing strategies. Cost reduction and transfer pricing strategies were also frequently cited as action items.

Additionally, CFOs are collaborating with supply chain leaders to update risk assessments, explore alternative sourcing strategies, and renegotiate supplier contracts. Reengineering the supply chain is a common theme, with 48% of CFOs working on alternative component and raw material sourcing and 41% reevaluating their supply chain network design.

“CFOs are leveraging data and benchmarks to calibrate their tariff response strategies effectively,” Bant added. “Continuous updates to scenario plans are essential as the trade environment evolves, ensuring organizations remain resilient and competitive.”