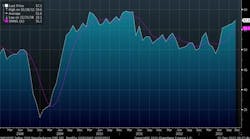

November Manufacturing Index does Surprise Rise

Amidst speculation that flagging domestic demand would cause the ISM Manufacturing Index to fall, it actually rose—to its highest point since April 2011. November saw this number ascend from 56.4 to 57.3.

Production also rose from 60.8 to 62.8 and new orders improved from 60.6 to 63.6 in November. The backlog of orders gained from 51.5 to 54.0 and new export orders increased from 57.0 to 59.5. Even employment continued to gain momentum rising to 56.5 after falling more than two points to 53.2 in October. Imports also continued to expand in November albeit at a slightly slower pace, slowing from 55.5 to 55.0.

ISM with 6month moving average“We remain cautiously optimistic going forward into the remaining months of the year,” she added. “Preliminary estimates show that while October spending was robust, supported at least in part by a growing wealth effect thanks to lower gas prices and heightened equity prices, November (and December) sales may take a hit.”

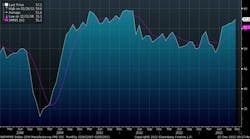

According to the National Retail Federation, spending across Black Friday weekend declined for the first time since 2009. Piegza surmises that with discounts coming earlier and earlier ahead of the holidays many retailers fear that shoppers frontloaded spending activity to the front of the fourth quarter leaving little holiday cheer from now until year end. Durable goods orders fell 2.0% in October, and excluding transportation, durable orders fell 0.1% in October, significantly weaker than the +0.5% rise expected. “More importantly,” she concluded, “non-defense capital goods orders ex-transportation, a proxy for business investment, fell 1.2% in October, down 8.8% on a three month annualized basis. And defense capital goods orders fell 16.3% in October nearly reversing the 20.0% rise the previous month.”Cap goods orders ex-defense, ex-aircraft, YoY