Freight spend is often the biggest factor driving a company to evaluate their logistics network. However, you can’t optimize a logistics network without considering details like rising fuel costs and surcharges and how they can change what used to be a no-brainer.

Rail is most often the slowest mode of domestic transportation to get from X to Y, but it is also the most inexpensive. Air is the quickest, but most expensive. In between are the most used modes of transportation: less than truckload and full truck load shipments.

Growing in availability and competitiveness is intermodal: placing ocean containers on rail to move product from the West Coast to the Midwest.

If you are shipping mostly small parcel you might want to locate next to a UPS or FedEx location.

However, along with all these options you must factor in the rising cost of fuel and the changing nature of your business and your business partners. Those things can’t be addressed with a simple spreadsheet model.

Complications

A business acquisition is a prime strategy to gain market share, but it also comes with the acquisition of a logistics network that might not blend well with your existing strategy. Untangling the resulting network requires understanding the capabilities of each inherited facility, customer overlap, carrier/transportation synergies, duplicate inventories, and cultural changes. A spreadsheet model won’t help optimize these complexities overnight.

Increasing the number of channels to the marketplace to increase sales also complicates the optimization process. Many companies offer their customers online, wholesale and retail channels.

Products are increasingly being sourced in Asia and other countries, requiring the deep understanding of ocean shipment strategies and the best method(s) to move products across the world. There are varying container sizes (20-40 foot long containers), ocean carrier vessels are getting larger and certain U.S. ports are deepening. The Panama Canal fifty-foot harbor-deepening project is front and center in future Asia shipment strategy considerations.

Tied to the Panama Canal consideration is, which U.S. ports will be ready to handle the fifty-foot deep ocean vessels? Even the speed of these large ocean vessels impacts the global optimization challenge. “Slow-steaming” vessels moving shipments from overseas to the states may lower the landed cost, but it lengthens the lead time for delivery, which essentially increases inventory levels.

Manufacturing plant locations are also a potential factor in a global optimization project. While plants are not commonly moved, given the complexity and cost associated, there may be additional locations, site closures or consolidations that make sense.

The complexity of where to source raw materials and produce your products, as well as determining batch sizes, inventory plans and lead times increases cannot be answered with a simple spreadsheet model.

Gather Baseline Data

A dynamic model starts with building a solid baseline including everything that is occurring in your current logistics network. The foundation of the baseline model is the data and information collected from historical and forecasted business transactions.

Getting transactional data representing all movement of products throughout your supply chain is often one of the most challenging tasks. To cover the general baseline data required, look at the following list of sample data files:

➤ Product master file, including product number, category, weight, dimensions, etc.;

➤ Production plant and distribution center locations;

➤ Supplier and customer locations;

➤ Inbound freight shipments (for all modes) from each supplier (domestic and international) into each plant, DC and/or customer – ideally a full 12-months of history;

➤ Outbound freight shipments (for all modes) from production plants and/or distribution centers to the customers;

➤ Shipment volumes transferred through internal transfers;

➤ Average and peak totals for inventory volumes (cases, cube, $) by plant and distribution center;

➤ Plant and distribution center information, including throughput capacity, cost per unit, storage capacity, pick facings, labor costs, rent costs, and closing costs;

➤ Transportation rates and discounts for current network.

After this initial wave of data is collected and reviewed, it must be validated by the project team. Before this meeting can take place, the logistics/data analyst must work through the information and develop various business profiles for review.

During the validation meeting, it is important to have a representative from each business unit/market channel, so that each volume/business profile can be scrutinized for accuracy. Fine tuning the data with additional data and estimations/assumptions is a normal part of finalizing the baseline data.

Baseline Model Generation

Once the data is validated, the baseline model is generated. This model is calibrated until it closely matches the actual historical logistics costs from the time period collected. The calibration of the baseline model establishes the confidence moving forward that each scenario is comparable to the baseline results. The baseline scenario is intended to portray the economics of continuing “business as usual” over the time horizon being studied.

It is very possible that the baseline model will require facility expansions or investment in capital equipment to support the planning horizon. This cannot be overlooked in the development of the future projected baseline solution scenario.

At a minimum, the baseline model will depict the annual operating expenses for warehousing and transportation expenses for each year out to the design year time horizon (e.g., 5–10 years out). Additionally, inventory assets and capital investment requirements will also be depicted for the baseline scenario.

Identifying Scenarios

After defining and validating today’s logistics operation, the creative part begins. Let the baseline process guide you to the strategies to analyze. Just make sure each scenario results in the optimum solution.

For example, it may sound easy to consolidate two older facilities into a different area and new facility, resulting in potentially lower facility operating costs. But, how does this impact service levels to the local market? What is the capital cost for starting up a new facility? What are the new labor costs?

Those are just a few questions that must be factored into what might seem like a simple scenario. The best strategy is not typically the easiest to define or implement. And—in case you didn’t see this one coming—it more than likely cannot be effectively analyzed using a simple spreadsheet.

Modeling Scenarios

With a solid baseline model and scenarios identified, the optimization process can continue. The most common initial scenario models include the following:

Unconstrained Logistics Network Optimization—It is always advantageous to assume you have no distribution centers, and analyze what a pure unconstrained optimization run recommends. The results are often not fully feasible, but many “what-if” scenarios come from this exercise.

Optimum Current DC Logistics Network—It is most practical to assume the use of your existing distribution center, but let the model re-allocate customers and inventory in the most optimum pattern. These results are often the easiest to implement, but could result in the need to expand facility capacity. Still, you can also lock the capacity to the current potential and see if there are still opportunities to make minor shifts in the supply chain to realize savings.

Various Number and Location of DCs—The classical scenarios modeled involve many renditions of the number of facilities that should be in network. Should you have one distribution center today, does it make sense to have two or three more? And, where should these facilities be located? Analyze the resulting service level and cost improvements.

Strategies

Third-Party Strategy—Is there a cost advantage, or is reducing capital expenditure important?

Cross-Dock / Flow-Through—Can you lower inventory levels, reduce the size of your facilities and/or improve service levels with this strategy?

Direct from Source—Similar to flow through, can you ship directly from your factories or suppliers to the end customer or into a third-party/flow-through facility to reduce inventory levels, speed the shipment to the customer and reduce overall operating costs?

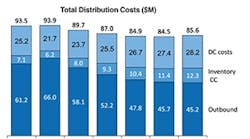

For all of these scenarios you’ll calculate operating expenses, including labor and rent, facility closing/opening, capital costs, inventory carrying costs, inbound transportation expenses, outbound transportation expenses and customer service factors.

The Final Solution

With the optimum solution within your grasp, remember to check the fine print. The fine print calls-out the risks and uncertainties within the supply chain, and these vary widely and are unique with each business. Still, here are a few items:

➤ If consolidating all of your operations into one facility, is there a back-up strategy should there be a natural disaster that shuts down the facility?

➤ If a third-party strategy is recommended, are your cultures going to clash?

➤ If the future requirements assumed a massive reduction in inventory levels, is there a strategy for handling excessive inventory levels?

➤ If excessive inventory is pushed to the stores, resulting in huge mark-downs, are potential savings from a pull strategy being factored into sales potential?

➤ Has your modeling accurately captured the different labor rates across the country?

➤ Have you reviewed lease expirations in the current network? These could impact the transition strategyand savings.

A simple analysis approach often does not have enough power or flexibility to identify the best direction for a company’s growth strategy. A robust logistics model will consider current situations and add future constraints and opportunities. And it should be revisited when your business or your business environment changes.

Norman Saenz is senior vice president, supply chain, and principal at TranSystems. He has more than 20 years experience in planning, designing, and implementing distribution center and manufacturing facility solutions. He can be reached at 817-919-1753 or [email protected].