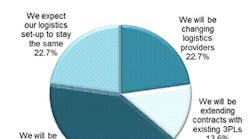

Retailers and manufacturers operating in the Asia-Pacific region are increasingly feeling the pressure to deliver exceptional customer services on an on-going and increasingly cost-efficient basis. To that end, over one-fifth of supply chain directors in the region are planning to change logistics providers between 2011 and 2012, according to a recent survey conducted by business analyst firm Analytiqa.

Retailers and manufacturers are looking for third-party logistics providers (3PLs) that can demonstrate robust service capabilities and expertise within their operating markets, and that can achieve an acceptable balance between measurable performance and financial costs.

Analytiqa’s analysis reveals that Asia-Pacific retailers and manufacturers appreciate the strategic role their supply chain plays in achieving sustainable competitive advantage. Indeed, the majority of supply chain directors acknowledge that, to varying extents, strategies relating to the supply chain function are discussed and decided upon at the top of their organizational hierarchy.

However, this does not necessarily equate to supply chain directors securing board-level positions. Despite the strategic decision-making and budget-holding responsibilities of a supply chain executive, 57% of Asia-Pacific retailers and manufacturers do not include a supply chain professional as a board member.

When it comes to considering outsourcing opportunities in the Asia-Pacific region, there is a strong tendency to implement a ‘close to home’ logistics strategy, particularly with the warehousing function. However, Asia-Pacific companies are becoming more sophisticated and knowledgeable in their approach to the logistics tender process. These retailers and manufacturers are consolidating their 3PL model as they strive to deliver more superior customer service at lower total cost by teaming up with a small number of trusted 3PLs that demonstrate potential to implement fewer, bigger contracts with much wider scope.

Demonstrating a highly targeted approach, retailers and manufacturers in the Asia-Pacific region on average approach up to six 3PLs per outsourced contract. However, within these parameters there are significant differences per distribution tender, or per warehousing contract.

With one-in-four manufacturers and retailers only approaching up to three external logistics providers per tendered contract, it is vital for 3PLs to effectively communicate their services and raise their company profile for a better chance of winning a tender.

Too much for a single 3PL to manage?

Supply chain directors understand that employing a single 3PL for their pan-Asia-Pacific logistics requirements has the potential to reduce costs through economies of scale and promote more direct and frequent business relations between the client and the 3PL. In 2011, however, roughly 35% of supply chain directors consider logistics providers to still be incapable of meeting their pan-Asia-Pacific supply chain management and operational needs.

These manufacturers and retailers believe that as supply chains extend across the continent in line with its expanding geographic boundaries, let alone worldwide, they are far too complex and fragmented for a successful partnership with a pan-Asia-Pacific ‘one-stop-shop’ 3PL.

Analytiqa’s research also identifies that while manufacturers and retailers are warming to the concepts of shared-user distribution and the adoption of supply chain transparency initiatives (e.g., ‘open book’ contracts), they are highly adverse to implementing a 4PL management model.

Supply Chains of Tomorrow

With today’s volatile business environment making supply chain management more complex and unpredictable, even the most well-designed supply chain model will fail to deliver profitable returns without proactive attention and maintenance to keep it running competitively and offering sustainable business value to an increasingly demanding customer base.

Unanticipated transportation disruptions as a result of natural disasters in the Asia-Pacific region have highlighted how multinational retailers and manufacturers can find themselves without critical components and finished inventory. With deliveries affected by fuel shortages and damaged transportation infrastructure, these companies are impelled to reevaluate the risks imbedded in their Asia-Pacific and global supply chains.

When it comes to maintaining an efficient, effective and integrated supply chain, Analytiqa’s research identifies that one-quarter of the major retailers and manufacturers will fail to frequently review their Asia-Pacific supply chain model, emphasizing that while such procedures may sound simple, they are often taken for granted and overlooked.

Looking ahead at this year, the most critical strategic issues particularly facing these companies are forecasting accuracy, overcoming intensifying supply chain complexity, managing the strain of increasing costs, and aligning the performance of 3PLs to their strategic supply chain goals.

Limited use of technology and IT systems makes it difficult to manage information and coordinate logistics efficiently. It is therefore unsurprising that nearly 70% of supply chain directors intend to overhaul their supply chain planning technologies in order to sharpen their end-to-end logistics operations over the next two years. Asia-Pacific retailers and manufactures will be rolling out strategic initiatives to help benchmark their supply chain performance, investigate alternative transport modes and increase their supply chain forecasting accuracy.

“Leading Asia Pacific retailers and manufacturers are demonstrating an increasing appreciation of their supply chain’s role in achieve sustainable competitive advantage,” says Mark O’Bornick, research director with Analytiqa. “Nonetheless, the current market environment poses multiple challenges to their entire value chain. Despite supply chain directors being able to clearly identify areas of improvement, along with potential solutions, supply chain issues are not always granted the board-level time they require.”

O’Bornick adds, “There are also key areas of activity where logistics providers fail to perform. The strategic decisions and investment made by supply chain directors will be critical in shaping the future success of their businesses, but they doubt if their logistics providers are capable of meeting the challenges that lie ahead.”