A Methodology to Quantify the Cost of Supply Chain Risk Management Strategies

You are the manager of a firm’s large global supply chain. The philosophy that guides your network planning decision-making is to minimize total landed costs subject to meeting defined customer service goals. In recent years, especially since the onset of COVID-19 and the supply chain vulnerabilities exposed and unleashed by this pandemic, you have struggled to find the right balance between minimizing costs and minimizing risks. In particular, how do you quantify the costs of different risk mitigation strategies such as using additional suppliers in disparate geographies, maintaining extra plants and/or capacity, and other similar strategies? How can you view these decisions from a holistic perspective?

In this article, we offer an illustration of a technique to develop a quantitative perspective on the cost of risk management strategies. This quantitative approach can be coupled with other more qualitative factors to facilitate the development of a well-informed supply chain risk management decision-making process and strategy.

We begin with a brief review of the types of risk that firms must assess in creating their risk management strategy. This review provides background context for the methodology we will introduce. Further, recognizing that we cannot explore in detail the topic of risk management strategies in this short article, we also provide additional references at the end of this article for readers interested in exploring this topic in depth. After our brief review of risk types and strategies, we then present our risk management quantitative methodology using a manufacturing network design strategy example for illustrative purposes.

Risks in Developing a Supply Chain Risk Management Strategy

When constructing a supply chain risk management strategy, a firm can assure that it undertakes a holistic view of all potential threats by first evaluating general categories of risk, and then considering specific individual risks. Why take this two-step approach? The danger of immediately focusing on a few specific known risks to a firm before first performing a broad review across all risk types is that immediately diving into specifics may cause some less obvious but important risks to be overlooked. Hence the need for a two-step approach.

Figure 1 presents nine broad categories of generic risks (column 1), and offers examples of each category of risk (column 2). Note that these risks range from those over which a firm has direct control (e.g., the operational risk of “inadequate manufacturing” capacity or capability), to risks such as tornadoes and hurricanes (natural risks) which a firm cannot control. There are other important distinguishing attributes of risk types and the reader interested in an extensive discussion of this topic is again referred to several references given at the end of this article.

Figure 2 closes this brief review of risk types and risk management strategies. For each type of risk identified in Figure 1, Figure 2 displays common strategies often employed to mitigate the threat of each risk type. For example, a heavily utilized “supply risk strategy” consists of employing multiple sources to procure individual products or materials. While using more sources rather than fewer sources generally reduces the opportunity to minimize acquisition costs, it also lessens a firm’s dependence on any single supplier.

This type of risk mitigation trade-off (i.e., cost versus level of vulnerability) leads to the question highlighted at the beginning of this article: What is a good approach or methodology to quantify the trade-offs inherent to risk management strategies?

Quantitative Methodology for Supply Chain Risk Management Assessment

To illustrate our methodology for quantifying the cost of a supply chain risk management strategy, let’s assume that a firm is developing its global manufacturing and distribution network strategy for the next three to five years. In this example, we will focus on plant locations and capacity plans, and note that a similar process would occur for distribution network locations. For illustrative purposes, we narrow our example to evaluations of supply, operational and natural risks only. In practice all pertinent risk types displayed in Figure 1 would be considered.

The methodology we present consists of a six-step process. We will assume that our firm has a model with which it evaluates the total network manufacturing and distribution costs of all potential network plant locations under consideration. This costing model can be a mathematical optimization model available through commercial software (see Miller and Liberatore, 2020) or any other tool that a firm maintains (e.g., spreadsheet costing analyses). The only requirement is that a firm have some type of model that can evaluate the total costs of any proposed manufacturing network, and can identify the lowest cost network solution among different alternatives (i.e., the firm utilizes a model that can determine which plants to open and operate, what products and quantities should be produced by each plant, which demand points should be served by which plants, and so on).

Figure 3 outlines the first three steps of our six-step process to quantify the costs of alternative risk management strategy options. These first three steps consist of selecting all the potential locations to be considered in developing the strategic manufacturing network plan. In practice, all of a firm’s existing plants are generally included in this type of analysis, as well as all potential new locations under consideration. Note that this candidate selection process requires the development of all pertinent data necessary to model the costs, capacities and production capabilities of each location.

Step 2 plays a critical role in addressing the risk management dimension of this process. In this step, the original set of candidate plants selected in step 1 is reviewed to ascertain if a sufficiently diverse set of potential locations has been selected to mitigate the firm’s previously identified risks. For example, is there potential sufficient excess (back-up) manufacturing capacity, are there enough potential locations in low “natural risk” geographies, and so on. If step 2 reveals that any risk types have not been sufficiently addressed in step 1, then in step 3, new potential locations that help mitigate against these risk types are added as potential candidate locations. At the conclusion of step 3, the firm has now selected all potential locations to include in its modeling analysis that will plan its future manufacturing network.

In step 4 (see Figure 4), the firm runs its network modeling tool to determine the lowest cost (or most profitable) set of plant locations for its future network. We designate this initial optimal plant location plan as the lowest cost “unconstrained” solution because no risk mitigation requirements (i.e., constraints) are explicitly imposed on this solution. In other words, we allow the network model to choose whatever set of locations will minimize total network manufacturing and distribution costs from those identified as candidates in steps 1 through 3.

For illustrative purposes, let’s assume, as shown in Figure 4, that the total annual costs of this lowest cost, optimal network are $200 million. Again, recall that this solution simply minimizes total annual costs based on all potential plant locations the network model selects; it does not consider or incorporate any risk mitigation strategies.

Now, as Figure 4 describes, in step 5 we rerun our network model, placing specific constraints in the model to assure that individual or groups of risk mitigation strategies are implemented. For example, to reduce “supply risk,” the firm may decide it must operate some minimum number of plants. If the optimal lowest cost solution does have enough open locations to satisfy this requirement, then the model is rerun with an additional constraint specifying that this minimum number of plants must be opened. This revised network solution plan will have a higher annual total cost, and possible reasons for this could include that for any given level of production, having a higher number of plants on a network often reduces the economies of scale opportunities. The model would similarly be rerun to incorporate other risk management strategies such as having a defined minimum excess level of capacity available, or a minimum number of locations in low risk geographies. Again, total annual network costs will increase in these revised scenarios for a variety of potential reasons such as for example, the “low risk geographies” locations may be more expensive than some previously selected lower cost locations. Finally, the model is rerun in a scenario that constrains the solution obtained to include all the individual risk management strategies the firm has developed.

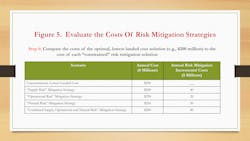

The multiple model runs collectively undertaken in steps 4 and 5 facilitate step 6. Here, as Figure 5 details, the firm compares the projected annual costs of the unconstrained lowest cost network plan to the various risk management scenarios modeled. For example, our illustration shows that the individual “supply,” “operational” and “natural” risk mitigation strategies would increase total manufacturing and distribution network annual costs by $40 million, $20 million and $50 million, respectively. Additionally, a network plan that incorporated all three risk management strategies projects to cost $80 million more annually, than would the unconstrained, lowest cost network. Results such as those shown in Figure 5 provide a firm with its much needed quantitative estimate of the costs of alternative risk mitigation strategies.

Conclusion

The relative importance of supply chain risk management was increasing rapidly in practice prior to the coronavirus pandemic, and it has grown exponentially since the onset of COVID-19. Making well-informed decisions on the appropriate level of risk mitigation actions to invest in represents a difficult challenge for a firm and its supply chain professionals. Good decision-making requires a careful balancing of both qualitative and quantitative factors.

In this article, we have introduced a process that supply chain managers can utilize to enhance the quantitative input side of the risk management decision-making process. We illustrated this quantitative process employing a manufacturing and distribution network example. Importantly, however, this methodology detailed herein can be utilized to address many different types of supply chain analyses and decisions. The basic requirement to employ this methodology for any major decision is simply as follows: One must be able to develop, model and cost a series of different strategies (scenarios) that address a requirement (e.g., planning a future manufacturing network) with alternative levels of risk mitigation strategies deployed in each scenario.

Addendum: The Demand Side

It is important to recognize that there is another critical element of strategic risk management costing; namely, evaluating the lost revenues and profits associated with a firm’s inability to meet customer demand because of supply disruptions. If a firm cannot satisfy demand for any reason (e.g., insufficient production capacity or a plant being temporarily incapacitated by a hurricane), the potential revenue and profit losses must be factored into the risk management strategy decision. This is a challenging, complicated process and beyond the scope of this article. However, this must also be addressed to facilitate a comprehensive risk management strategy decision-making process. Examples of the inputs required for this lost revenue (i.e., demand side) of the analysis include:

• Estimated lost revenues and profits per day from all identified potential supply disruptions.

• Estimated duration (in days) of each potential supply disruption in the event a specific risk (e.g., a hurricane at a specific plant) materializes.

• Estimated probability per year of each specific risk occurring (e.g., the probability of having a hurricane that damages a particular plant).

This brief list illustrates the types of costs and variables that must also be considered. The potential lost demand side (i.e., the potential lost revenue and profit) analysis can be combined with the supply side methodology described in this article to develop a complete analytic picture. Readers interested in this are welcome to contact the author for more information.

References

Liberatore, M.L. and T. Miller. 2021. Supply Chain Planning: Practical Frameworks for Superior Performance, 2nd Edition, Business Expert Press, New York, 2021.

Manuj, I., and J. Mentzer. 2008. “Global Supply Chain Risk Management.” Journal of Business Logistics 29, no. 1, pp. 133–55.

Miller, T. and M.L. Liberatore. 2020. Logistics Management: An Analytics-Based Approach, Business Expert Press, New York, 2020.