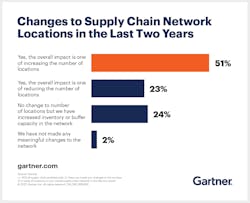

51% of Supply Chain Leaders Increased the Number of Network Locations

Over the past two years, 74% of supply chain leaders made changes to the size and number of locations in their supply chain network, according to Gartner. Fifty-one percent of respondents said they increased the number of locations.

As constraints, inflation, sustainability goals and national industrial policies put global supply chains under pressure, chief supply chain officers (CSCOs) are adapting their networks to fit this new environment.

“There’s clearly a supply chain redesign underway, but not everyone is moving in the same direction or even to the same extent,” said Kamala Raman, VP with the Gartner Supply Chain practice. “Supply chain leaders have been modifying networks in a number of ways, be it with expansions, consolidations or simply modifications to buffers – which are more reversible than footprint decisions.”

The resulting networks span a variety of operating models. Twenty-eight percent of respondents now describe their network as a hybrid regional model – a combination of local or regional elements in a global supply chain network. This is closely followed by global models with regional final assembly (23%) and local-for-local networks (22%).

“While the range of scales and approaches is wide, supply chains are undoubtedly on the move. Over half of participating organizations report making changes to manufacturing and supplier networks supporting at least 20% of revenue,” Raman added.

China and Asia Remain Valued As Both Supply Bases and End Markets

In supply chains with a presence in China, change is afoot as well. In total, 95% of survey respondents are evaluating or executing changes to their China sourcing and manufacturing strategy, and 55% of those already acted on their plans.

However, the survey data does not show strong signs of large-scale nearshoring to developed markets. Supply chain organizations are examining A China Plus One approach that leaves most of the China-based network intact and places net new additions in other markets, or a diversification strategy that still holds significant sourcing or manufacturing in China.

As a result of the diversification away from China many countries in the rest of Asia are profiting from net new foreign direct investment. There are also regionalized Asian networks emerging which are driven by coordinated industrial policies, such as the Regional Comprehensive Economic Partnership (RCEP) or the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) trade deals. Of APAC respondents to the survey, 60% see their home region not only as a supply base but as an end market. Globally, 40% of respondents consider APAC a supply base and an end market.

“The signs are clear that in a fragmented world, global firms have been making changes to their heavily cost-optimized, one-size-fits-all networks, and now favor a mix of global, regional or local elements. Investments into other parts of Asia - outside of China - coexist with expanded investments into developed markets as organizations take advantage of generous national/trade-bloc-level trade incentives,” Raman concluded.