Compete: Do Your Metrics Measure Up?

All too often people fail to understand this fundamental point: a metrics program is not the same as a performance management program. Metrics are a necessary and irreplaceable element in performance management, but as a stand-alone initiative they are inadequate. The challenge facing business managers is in taking metrics to the next level, and creating a viable performance management process grounded in fact.

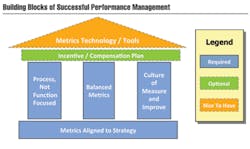

No two successful performance management programs are the same, but all successful performance management programs share common principles. To help shed light on what separates a good company from a great company, let's consider a framework. Think of a "foundation" supporting the "building blocks" of a successful performance management program.

The foundation and pillars (labeled as "required"; see diagram on p. 28) are essential to the successful implementation and use of a performance measurement program. Getting the right measures in place, establishing the culture to depend on these measures and extending the measures to your suppliers should be done first. This follows the general rule that process should be completed before the investment in technology is made. The "Optional" and "Nice to Have" components can be added later to enhance the value to the company once the culture is established and results are being achieved.

The Foundation: Aligning Metrics with Strategy

It is no coincidence that the foundation of a successful performance management program is grounded in having metrics aligned with a company's strategy.

In business, it is essential to know where you want to go, or else you can end up channeling an entire corporation in the wrong direction. To exacerbate the problem, companies create hundreds of measures but fail to link those measures to actionable plans that drive progress towards the company's goals – suffering from an ailment we like to call measurement minutiae.

The concept that more measurement is better can lead companies astray. Forget quantity and focus instead on linking measures to strategic capabilities, customer expectations and financial indicators.

Pillar 1: Process, Not Functional Metrics

A survey of University of Michigan Business School executive development program attendees indicated that managers stood by as subordinates engaged in activities that clearly hurt the firm but helped a key measure look strong. These metrics are often created and managed at the functional "silo" level and individuals strive to achieve their results targets for their functions. Unfortunately, when left unchecked, people often "game" the system to meet their individual or functional goals.

For example, a company rewarded their procurement people on purchase price variance, and their manufacturing people on machine efficiency. A purchase of a less expensive raw material slowed down the production equipment, and increased the overall cost of goods. However, the procurement manager was paid his bonus, and the manufacturing manager was "dinged" as a result. Functional metrics can drive suboptimization, waste time and money, and sap an organization of its vital energy.

This gets to the heart of the first building block – that companies need to focus on process, not functional results metrics. An integrated measurement system is a mechanism for balancing the tendency toward functional suboptimization at the expense of the enterprise's overall results. These cross-functional or process metrics, if selected correctly, identify and track the measures that are critical to overall success.

Pillar 2: Use Balanced Metrics

In the early 1990s, Kaplan and Norton wrote their first article on the concept of the Balanced Scorecard. The most apparent change introduced by the Balanced Scorecard methodology was the integration of other performance dimensions beyond a purely financial view, hence the "balanced" view on organizational achievement. Kaplan and Norton's Balanced Scorecard Framework supports equal emphasis on internal and external perspectives. Studies have found that companies that use a balanced set of strategic measures – both financial and nonfinancial – outperform their less disciplined rivals in performance and management. One key reason for this is that companies that look only at financial metrics are analogous to driving a car by looking in the rear view mirror – because financial measures tend to be lagging indicators.

Pillar 3: Embed Metrics in Your Culture

Strategy is not just about what you want to do, but it's also about how you are going to do it. In order to get people to buy in and commit to what's going to happen, they must understand their role in achieving the company's goals. Many times management fails because the top team treks up the mountain to set strategy without regard to how the organization, with its culture and individuals, will be able to understand and implement their vision.

To build continuous improvement into an organization you need to integrate measurement into the organization's culture. In many organizations measurement is used as a club. It is a tool for continuous punishment rather than continuous improvement; as such, it is a tool to be avoided, subverted, or undermined rather than used as a source of valuable information for managing people and predicting business performance.

1. Clearly articulate the objective(s) to be met. Do your people understand your strategy and their role in achieving that strategy? Have operational and functional tactics been linked back to the strategic objectives?

2. Link specific measures to the objectives – set targets. For example, if the overall objective is to "increase customer service," one key measure might be to improve customer service levels in the call center by reducing wait time. The goal could be to "answer 80% of all customer calls in 20 seconds." Clearly linking a tactical measure to a broader objective will help employees understand on what to focus.

3. Measure the Progress. Once clear expectations have been set, measure progress against the goal. The main focus should be that employees can easily understand and track their performance against the company's objective.

4. Find the Underlying Reasons. Establish a process for root cause analysis and development of corrective action plans. What do you do if you are not meeting your goal? The obvious problem may not be the root cause. In order to keep the problem from recurring, the team must drill down to find the underlying reasons for the problem.

5. Fix the Problem – Take action. This is where results begin. Employees who understand the problem or barrier to meeting the objective can develop action plans to fix the problem.

Building Block 4: Link Metrics to an Incentive / Compensation Plan

When performance measures are linked to incentives, there is a carrot at the end of the stick. This concept is not revolutionary, and is meeting with increasing acceptance every year.

Some years ago, the v.p. of supply chain pulled together his department heads to inform them that from that time forward, a small percentage of their variable compensation would be based on the total time, cost and quality across the entire supply chain – not just within their individual departments as had been done previously. After listening to several protests from individual managers about how they could not control what went on in each other's departments, he informed them, "Look, among you, you control the whole thing. Work it out!" This forced the managers to work together to determine how decisions made in one area affected the next. They soon learned that a great commodity deal that required the purchase of three month's worth of material suddenly didn't look as good, and that running smaller production lots was sometimes cheaper. The percentage of their variable compensation based on the total measures has increased each year since, because the value to the company is apparent in the bottom line results.

A formal incentive and/or reward structure is not required to have success. Simply letting employees know management will be using metrics as an indicator of their performance can have a positive impact.

Building Block 5: Use Tools and Technology to make Metrics Tracking Easier

The marketplace for software solutions to automate metrics collection and reporting is rapidly growing. Products packaged, marketed and sold as "business performance management" tools are targeted at financial managers such as the CFO and the controller. Consistent with this trend, initiatives for business performance management from ERP providers have come out of their financial application groups as extensions to the core financial applications.

Summary

No two successful performance management programs are the same, but all successful performance management programs share common principles. It is important that managers understand if their metrics program contains the "required" building blocks to have a successful performance management program: metrics aligned to strategy, process, not functional focused metrics, balanced metrics, and lastly a measurement process and culture that promotes the active use of measures to drive positive change.

Mike Ledyard is a partner with SC Visions (www.scvisions.com). Joseph Tillman is a senior researcher with SC Visions. SC Visions is a consulting organization specializing in business process improvement.