A study by the Institute of Management & Administration (New York), indicates that companies that don't analyze cost and utilization data for controlling healthcare costs had premium increases 18 percent above average. The study also found that companies whose managers are evaluated on their ability to control healthcare costs had premium increases 17 percent lower than those who did not. And, companies whose insurance brokers are compensated via sales commissions had premium increases 12 percent higher than those using flat-rate brokers.

The message is clear: Do more than just pay the bills, compensate managers who control costs, and don't buy from the salesperson who gets paid on commissions only! Here are five strategies to help wrangle down growing insurance costs.

1. Manage the cow herd

Learn from others how to do more than just pay the bills. What does insurancecost management and raising beef cattle have in common? Plenty. Alabama A&M University published a booklet on strategies for managing cowherds. To paraphrase, substituting the word "cows" with insurance management, the advice applies to any business:

When developing an insurance-cost strategy, managers need to think far ahead of where they currently are to be able to react to problems they will eventually have. Part of a successful management strategy is to gather known costs, based on historical data, and separate them into categories. This allows managers to group common types of costs. By categorizing costs, it's easy to see where money is being spent. The use of categories provides a closer look at the types of claims being made and the specific cost of each.

People aren't cows of course, but the right data makes it possible to evaluate and limit costs. Collecting and organizing cost information helps determine total production costs as well as cost per employee. This, in turn, gives managers leverage with insurance brokers, and helps evaluate and determine an acceptable bid for the company's business. Knowing program costs and being able to estimate the effect that a change in structure will have on future costs, improves the manager's chance of making a cost effective decision.

2. You are the customer

Shopping for insurance is not the kind of thing managers learn in MBA school. And going shopping is not much fun when the daily focus is really on getting product out the door. Shopping is, however, a good way to control insurance costs and should be part of any cost-management strategy.

Some experts recommend shoppingaround every three years. Others suggest making shopping for insurance an ongoing effort. Just because premiums take only a modest jump one year is no reason to assume (for you or the carrier) that the jump won't be larger next year. Seeking competitive bids for a company's business can have two results: Lower premiums tendered by another company, or reduced rates from the current company if there is the possibility of losing business. There is a third possibility, that all the bids will come in higher. In that case, managers are still in a more-knowledgeable position to select the bid that fits the company's needs and budget.

3. Negotiate, negotiate, negotiate

Call it customer service or selecting the right person for the job, the broker a company selects to do its bidding is as important as the plan it chooses. A study done by Genworth Financial (Richmond, Va.) and Employee Benefit News shows that almost 80 percent of benefits managers talk with their brokers when they begin to generate a new program for employees. The right broker has to know a company's business, its limitations and its financial goals.

How a broker is compensated, can have a major influence on a company's insurance costs. Keep in mind that a broker often gets a piece of any premium increase. How much of an increase varies by company, product line and numerous other factors. The caveat is: when paying for a value-added service, be sure the service is of value.

It's counterintuitive to think of insurance shopping as being a buyer's market, however, it's true in part. Many insurance companies are willing to work with a company to customize standard offerings. Based on the data collected before insurance negotiations begin, a company has negotiating points throughout the process. A good broker will use the data a company provides to weave and create an insurance program both parties can benefit from. It doesn't always mean insurance premiums will decrease, however it does mean they will be closer to fair than they otherwise might be.

A sample negotiating point is to not offer family coverage if an employee's partner is covered at his, or her, place of employment. Forty percent of the companies questioned in a study by the Kaiser Family Foundation and the Health Research and Educational Trust indicated they are inclined to increase the cost of family coverage. Family coverage, when both partners are employed, is like subsidizing the competition by paying for its employees' health insurance.

If negotiating health insurance is not a company's core competency, outsourcing could be the answer. A growing number of companies are turning to professional employer organizations (PEO) for many if not all of their human resource needs. The national Association of Professional Employer Organizations, (Alexandria, Va.) has a list of more than 500 PEOs, along with information on how these third-party service providers can do it all, from negotiating insurance contracts to payroll administration.

A benefit of working with a PEO is that the PEO can function like a purchasing pool, bringing its strength in numbers to the table. Because it is negotiating like a big company, a PEO can garner benefits smaller companies might not be able to negotiate.

4. It's not how good you feel, but how good you look

Getting a break in the insurance market is not always about how good you feel. Sometimes it's about how good you look. A company that looks like a good risk—a well-run organization with an effective risk-management program—is most likely to have fewer claims. And looking good is what appeals to insurers.

An effective risk-management program encompasses many things. Certainly safety is at the top of the list. Equally important is education. Educated employees, who are aware of hazards and environmental risks, present a more promising picture for insurers.

Along with risk awareness, a company should evaluate risk avoidance as part of its insurance cost management strategy. For example, by contracting out the handling of some hazardous products and processes, a company can lower its premiums by shifting the burden to someone else.

5. Healthy body, healthy bottom line

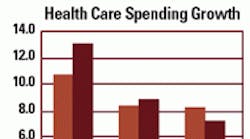

According to research from the Center for Studying Health System Change, and the employee Benefit Research Institute (both based in Washington, D.C.), overall spending on healthcare rose 7.5 percent and prescription drugs 8.8 percent in the first half of 2004. The way to lower these numbers is to not get sick. And the way to stay healthy is to institute a comprehensive health plan in the workplace.

A program that improves the wellbeing of employees yields many benefits— all of which can lead to lower insurance premiums. Those benefits start with increased productivity and reduced absenteeism, two major priorities on every manager's agenda.

The beginning of any wellness program is a thorough review of insurance claims. First determine what areas are causing the problems and in need of repair. Then look for preventable alternatives.

Ergonomically designed equipment can lower the cost of back injuries, for example. Taking candy bars and starchy foods out of the vending machines can reduce contributors to a variety of diseases. Raising employee awarenewss of self-care— smoking cession programs, weight reduction, etc.—can go a long way in reducing insurance costs. Experts recommend looking for issues that modify behavior as a starting point.

On-site health screenings for risk appraisal is another way to raise employee consciousness. Numerous health organizations offer these services to companies at no-or low-cost.

According to the Center for Studying Health System Change, the main tool to control healthcare costs remains greater financial responsibility for patients, whether in the form of higher cost sharing in health maintenance organizations and preferred provider organizations, or through so-called consumer-directed health plans, which typically include a high deductible and an account to draw on to pay medical bills.

These tools encourage consumers to use healthcare services more judiciously. However, more common patient financial incentives, such as deductibles, copayments and coinsurance, are often too crude to allow distinctions between needed and more discretionary care, how efficient healthcare providers are and how much of a financial burden some patients can afford.

Annual percentage change in healthcare spending per capita.

Source: Center for Studying Health System Change (Milliman Health Cost Index, U.S. Department of Commerce, Bureau of Economic Analysis)