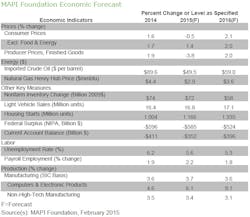

Lower oil prices at the gas pump and elsewhere mean more purchasing power for U.S. consumers and provide a relatively positive near-term economic outlook.

And this trend will continue, according to a new report from the MAPI Foundation, the research affiliate of the Manufacturers Alliance for Productivity and Innovation, as it predicts that the refiners’ acquisition cost per barrel of imported crude oil is expected to average $49.50 in 2015 and $59.00 in 2016, a significant downward revision from $80.00 and $80.60, respectively, in the November forecast.

The economy will grow with GDP increasing this year at 3%. Manufacturing production is expected to outpace GDP, with anticipated growth of 3.7% in 2015, and 3.6% in 2016.

"Consumer spending is stronger because of lower oil prices, and manufacturing job growth is being pulled by increased production," said MAPI Foundation Chief Economist Daniel J. Meckstroth, Ph.D.

With regard to employment numbers, the manufacturing sector added 210,000 jobs in 2014. The outlook is for an increase of 282,000 jobs in 2015, a jump from the 202,000 anticipated in the November report. Meckstroth envisions 162,000 manufacturing jobs to be added in 2016.

"The fact that employment is continuing to grow shows the U.S. economy is maintaining its momentum,' Meckstroth added. "Confidence indicators are strong, the unemployment rate is low, and credit is available. More people with more income tend to be self-reinforcing."

The group forecasts that overall unemployment will average 5.^% in 2015 and 5.3% in 2016.

Other study highlights:

- Non--high-tech manufacturing is expected to increase 3.4% in 2015 and 3.1% in 2016.

- High-tech manufacturing production, which accounts for approximately 5% of all manufacturing, is anticipated to grow 6.1% in 2015 and 9.1% in 2016.

- Investment in equipment will grow 8.4% in 2015 and 6.9% in 2016.

- Expenditures for information processing equipment are anticipated to increase by double digits—12.8% in 2015 and 11.8% in 2016.

- Industrial equipment expenditures will advance 10.4% in 2015 and 6.4% in 2016.

- Transportation equipment will increase of 3.8% in 2015 preceding a 1.4% decline in 2016.

A strong dollar and strong economy relative to our trading partners will slow economic growth this year and next, resulting in exports increasing 3.3% in 2015 and 2.9% in 2016. Imports are expected to grow 6.3% in 2015 and 6.7% in 2016.