The French have an expression—“comme ci, comme ça”—which basically means, “things could be better, things could be worse.” That pretty much sums up the current situation facing shippers right now. Capacity is adequate for the time being, but by the end of the year a confluence of several factors could lead to what transportation forecasting firm FTR refers to as a “crisis in capacity availability.”

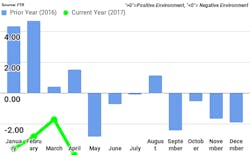

FTR’s monthly Shippers Conditions Index (SCI) currently sits in the negative zone, with a reading of -1.7. The SCI is a compilation of factors affecting the shippers transport environment, and it tracks the changes representing four major conditions in the U.S. full-load freight market: freight demand, freight rates, fleet capacity and fuel price. Any reading below zero indicates a less-than-ideal environment for shippers.

“The trucking market still seems to be in a relative balance with enough available capacity to move goods at reasonable pricing,” says Jonathan Starks, chief operating officer at FTR. “However, that balance is slowly shifting toward the carriers. Spot market load activity is well above levels we saw last year, and spot pricing has recently hit double-digit increases. This pricing increase is partially due to increases in fuel pricing that occurred back in mid-2016, but it is also stemming from a modest reduction in capacity at the same time that load activity has increased.”

As Starks sees it, significant capacity tightness could occur by late 2017, as the freight environment is strengthening from a resurgence in manufacturing, construction and industrial activity. “Add in a potential capacity reduction due to the electronic logging device (ELD) implementation in December, and the trucking market is poised for a significant change in 2018,” he observes.

Meanwhile, a separate index—the Cass Freight Index, compiled by Cass Information Systems, finds that shipments were up 4.0% year-over-year for the month of April, and were up 3.7% compared to March 2017. According to analysis by Donald Broughton, managing partner of research firm Broughton Capital, “Data is suggesting that the consumer is finally starting to spend a little, albeit not with brick-and-mortar retailers.”

Broughton believes that the overall freight recession, dating back to March 2015, appears to be over; more importantly, he says, “freight seems to be gaining momentum in most segments.”

In addition to increased parcel deliveries due to e-commerce, other areas driving the increase in volumes include airfreight, particularly the Asia-Pacific lane, and an improvement in rail, partly due to a revival of interest in oil and gas exploration related to fracking activities. Areas of concern center on the automotive and housing industries, both of which appear to be in the early stages of contraction, he notes.