Bloated Inventories Are Slowing US Logistics

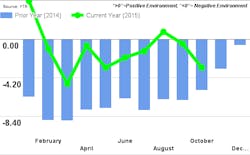

2015 was an eventful year in transportation, according to the latest analysis from freight transportation forecasting firm FTR. Unfortunately, the events took a turn to the dark side in the latter part of the year, with the Shippers Condition Index dropping to a reading of -3.1 in the month of October, with high inventory levels taking the blame for much of that negative reading. Any reading below zero indicates a less-than-ideal environment for shippers (see chart below).

“After a very tight trucking environment along with worsening service on the rails during 2014, the situation over the last year has, at a minimum, stabilized and much of the market is experiencing some softness,” comments Jonathan Starks, chief operating officer at FTR. “However, contract prices are still rising and truck capacity is still tight compared to historical levels.”

As Starks sees it, 2016 will start off just the same way that 2015 ended, with businesses holding on to too much inventory but capacity utilization remaining elevated. “We don’t expect to get a significant change in the operating environment until the latter half of 2016—and more significantly in 2017—as we prepare for a slew of regulatory implementations starting in late 2017. The big caveat is whether the economic situation can be sustained. Most indicators point, again, to more of the same; however, pessimism has grown and will continue to grow until manufacturing can show some strength outside of automotive. Many shippers seem to be preparing for the coming truck shortage and are making sure that their operations and logistics partners are in line with their needs. If 2016 proceeds as expected, that seems to make it a good year to implement those plans.”

High inventories are a problem for manufacturers, retailers and wholesalers, which led to a majority of goods being discounted during the holiday season, adds Rosalyn Wilson, senior business analyst with consulting firm Parsons and an analyst for the Cass Freight Index. “The Federal Reserve raised interest rates in December, which put more pressure on firms holding inventory. Inventory carrying costs rise with interest rates, and the money tied up in inventory that is not moving becomes a liability,” Wilson says.

Things could even get worse, she adds, as the Fed has discussed plans to raise rates several times in 2016. “Low warehouse vacancy rates are pushing the price of warehouse space. In short, the nation’s bloated inventories are becoming a problem.”

Based on the Cass Freight Index, don’t expect much out of the early months of the new year. “With manufacturing slowing, inventories high, companies rationalizing employees and a six-month slide in freight volumes and expenditures, 2016 will get off to a slow start,” Wilson predicts.